“What goes up, must come down” might as well be the theme for the stock markets in 2015, but what’s expected of the market next is something only a crystal ball can answer. I will leave market predictions to the experts, after all someone has to be wrong!

As I am sure you know, ignoring the short-term market movements and staying committed to a long-term investment strategy isn’t always easy. In order for an investor to reach their financial objectives, they need to have a clear perception of where they are and where they want to go, coupled with a disciplined investment strategy to assist them along the way.

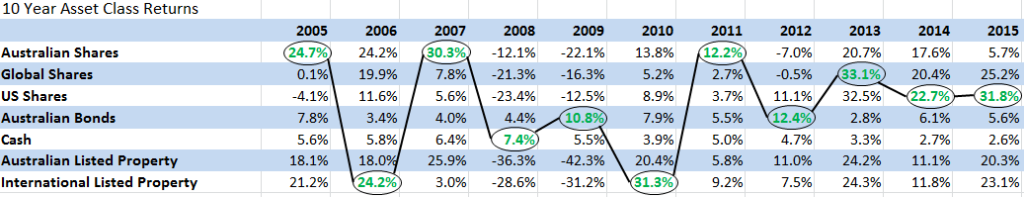

Investors have access to masses of expert views and opinions, but nothing is as accurate as to what’s already happened. The table below illustrates the 10-year performance of major asset classes on a yearly basis. Looking at this data from a long-term perspective supports some key fundamentals that can help investors maintain long-term investment success.

We are certainly not saying that past performance is an indication of future performance or how an asset class may perform based on what it’s done in the past. Actually, we are saying the complete opposite. Market cycles play out to the tune of the wider macro-economic environment and many investors can’t resist trying to align market events and speculation with changes to their portfolio.

Financial markets can be incredibly unpredictable and attempting to time them opens up investors to increased levels of risk: realising an investment holding too early, or too late. Caving into temptation and allowing emotions to make investment decisions very rarely rewards investors. Historical market returns show that investors who implement a long-term approach to their asset allocation and investment strategy are often rewarded for their patience and discipline.

When deciding a portfolios asset allocation, it is important investors understand that the best and worst performing asset classes will often change from one year to the next. Having a diversified portfolio of investments across a broad range of asset classes can help even out returns over time. The table below underpins the importance of this as well as keeping to an investment strategy that focuses on the long-term.

For example, the low returns from international shares in 2011 and 2012 may have tempted investors to move out of this asset class in search of superior returns elsewhere. In employing this strategy, investors would then have missed out on the 33.1% and 20.4%, 25.2% returns in the subsequent 2013, 2014 and 2015 financial years.

Financial Year Total Returns (%) By Asset Class:

Some key points to consider after reading this:

- Invest for the long term and stay patient – ignore market noise and most importantly, stick to your long-term investment strategy

- Diversify – is the art of holding a range of interests within several, if not all, asset classes across a range of companies, industries and even countries.

Affluence Funds Management employs a long-term view on all investments we make and the way we form our portfolio. We strive to remain patient in volatile markets and keep our portfolio highly diversified across quality fund managers.

Sources: Vanguard Investments Australia.

Notes:

- One-year returns are total returns from 1 July 2013 to 30 June 2014.

- Australian Shares = S&P/ASX All Ordinaries Accumulation Index.

- Global Shares = MSCI World ex-Australia Net Total Return Index.

- US Shares = S&P500 Total Return Index.

- Australian Bonds = Prior to December 1989 the index is the Commonwealth Bank All Series, greater than 10 years Bond Accumulation Index. From September 1989 the index is the UBS Composite Bond Accumulation Index.

- Cash = Data prior to March 1987 supplied by Reserve Bank of Australia.

- Australian Bonds = From March 1987 the index is the UBS Bank Bill Accumulation Index.

- Australian Listed Property = S&P/ASX 200 A-REIT Accumulation Index.

- International Listed Property = Prior to 1 May 2013, index is the UBS Global Real Estate Investors Index ex Australia with net dividends reinvested. From May 2013 the index is the FTSE EPRA/NAREIT Developed ex AUS Rental Index with net dividends reinvested.