We took the chance during the recent market downturn to review the listed debt and hybrid securities available in the market. We came across two potentially rewarding debt opportunities, both of which we added to the Fund investment portfolio.

The first is Origin Energy Hybrids. They trade on ASX under the code ORGHA. These provide a potential way to profit from the current negative sentiment towards oil prices and oil stocks.

The securities were issued at $100 in 2011 and can be called (repaid) by Origin in December 2016. Origin said when they raised additional equity last year that they intend to repay them on that call date. A representative of Origin confirmed to us recently that they had not made any announcement to the contrary since then.

ORGHA pays a quarterly distribution at a floating rate based on the market interest rate plus a margin of 4%. At current interest rates, this means a holder of ORGHA can expect annual interest payments of around $6.40 per $100 security.

ORGHA currently trades at around $91.00, well below the $100 which will be payable if Origin chooses to do so. We believe this is due to the current negative sentiment towards the sector and the perceived level of risk that Origin may not repay the notes in December. We believe current pricing overstates these risks and have been buyers of these notes for the Fund at about this price.

There are, broadly, three potential outcomes for holders of these securities.

1. A good outcome

If Origin repays the notes as indicated in December 2016, investors acquiring the notes for $91.00 now will receive returns of around 17% including interest payments of $6.40 and a $9.00 capital gain on an initial investment of $91.00. We believe this is the most likely outcome.

2. An OK outcome

If the notes are not repaid by Origin in December, they will potentially remain on issue for a long time – and it is totally up to Origin if and when they redeem them. If this occurs it is likely the notes will fall in value at first, and will ultimately trade at a value which reflects a fair annual yield, based on the interest payments. We believe this will mean the notes trade in a range of $80-$90, offering a yield of 7%-8% per annum. While this will potentially mean a capital loss for investors who sell at a lower capital value, we believe over time the capital value will track back up as sentiment towards oil and oil stocks improves. In the meantime, quarterly interest payments will smooth the pain somewhat.

3. A bad outcome

The worst case is that Origin will not repay the notes at the call date and either the notes trade down substantially or Origin enters a much greater period of financial difficulty and the notes are never repaid. This would likely lead to a more substantial and permanent capital loss. While possible, we believe this group of scenarios to be very low-likelihood.

Our reasoning for our overall positive view of the investment is as follows:

- Origin remains a profitable business, even at current distressed oil and gas prices;

- Capital expenditure risk is substantially eliminated with the recent commissioning and commencement of production for the LNG plant

- The company maintains significant unused debt facilities which are available to repay the ORGHA securities;

- The ORGHA securities are likely to be significantly more expensive to Origin than bank (and other types) of debt;

- Origin has a number of other options in the event that undrawn bank facilities are not available to repay the notes, including other forms of debt, asset sales, business profits and further capital raisings. The company showed last year they are not averse to discounted equity raisings to appropriately fund the business and preserve their credit ratings.

We believe, on balance, there is reasonably high chance that the securities will be repaid in December 2016, and a very low chance (but a chance nonetheless) of substantial capital loss for investors.

The second opportunity has a potentially much wider range of likely outcomes, but also potentially much higher returns. The investment is a preference share issued by Seven Holdings Group. They trade under the code of SVWPA and were previously known as TELYS prior to a restructure of the Seven Group.

SVWPA is currently trading at around $53.00 and are now offering a compelling yield of over 9% plus franking credits.

Like ORGHA, the SVWPA was originally issued for $100. Unlike ORGHA, the call date has already passed and they are unlikely to be repaid for $100 any time soon.

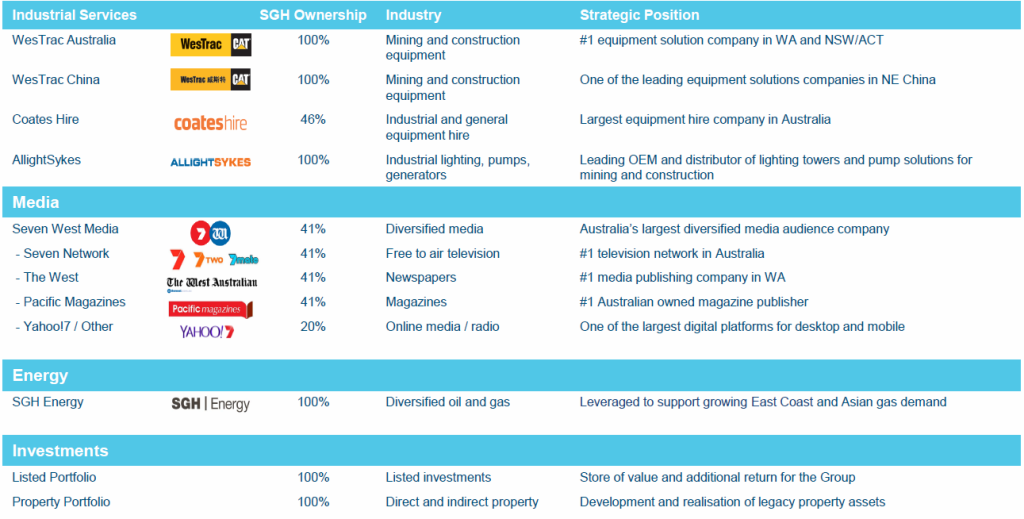

SVW are repayable and serviced by the Seven Holdings Group SVW). Although this entity is listed on ASX, we think of it as the family office of Kerry Stokes, who owns around 70% of the Seven Group Holdings shares, but none of the SVWPA so far as we are aware. The Seven Group Holdings business is a conglomerate that owns stakes in a number of other businesses, both listed and unlisted. A summary of those businesses, taken from the AGM presentation last year is below:

Both the WesTrac business and the Seven West Media empire have been struggling of late. However, the company as a whole and the underlying businesses remain profitable and debt levels are considered manageable. Importantly, the company maintains a rather large portfolio of investments in other companies listed on ASX, which are generally saleable.

Given the structure, SVWPA are so far as we’re concerned, an equity instrument. That’s because they are no longer redeemable as of right by the owner, but instead can only be redeemed by the company on a future dividend date.

SVWPA pays 6 monthly dividends, based on the 6-month forward interest swap rate plus a margin of 4.75%. Based on the last announcement to ASX, this equates to an annual payment of around $4.98 per security in cash, plus a $2.13 franking credit. If you were to buy some SVWPA on ASX for around $53.00, this is equivalent to an annual cash yield of 9.4%, or 13.4% including franking credits.

The current price reflects uncertainty in the market, the sectors the group does business in and uncertainty as to future decisions by the major shareholder and how they may affect the preference shares. However, we believe the negative sentiment is overdone, so let’s look at the most likely outcomes for an investor in SVWPA. There are many other potential outcomes, but we consider these the most likely.

1. SVWPA continue to be listed and pay dividends in perpetuity

At a purchase price of $53.00, investors will get an annual cash yield of over 9% plus a 4% franking credit. At some point it is likely sentiment will improve and they will trade much closer to their $100 issue price – perhaps delivering a 20% plus capital gain if sold. Depending on the investment timeframe and extent of the capital gain, this could deliver returns to investors of 11% – 15% and potentially much higher. We believe this is the most likely scenario.

2. SVWPA are redeemed at some time in the future.

Similar to scenario 1, but with an even bigger payoff. We don’t see this as likely, but it could happen. Depending on the time frame, returns of 20%+ per annum are possible.

3. SVWPA are subject to an on-market buy-back.

If you could buy back your debt at an interest rate saving of 9%pa, make a $40 capital gain and fund it at around 4% bank debt, wouldn’t you jump at the chance? While we don’t think this overly likely, it would probably have a positive impact on the price of SVWPA if it occurred.

4. A “lowball” offer is made to repurchase SVWPA by the company.

Similar to scenario 3, but with an offer to all holders at a price Seven Group felt was fair. While this is possible, we have spoken to a representative of Seven Holdings and we get the sense that management is sensitive to the fact that SVWPA are largely owned by smaller retail shareholders and have no desire to see them shortchanged. Even so, such an offer is likely to need to be well above the existing trading price at the time it is made to warrant approval.

5. SVW is privatised or otherwise restructured and delisted from ASX.

This is the scenario facing Crown holdings currently, and it is causing preference shareholders in that company some discomfort. While a similar scenario for SVW is possible, it doesn’t make a lot of sense we believe. But it could happen, and if it did it is likely the SVWPA holders would need to be dealt with, because as an unlisted vehicle, there would certainly be cheaper and easier debt solutions available.

6. SVWPA are converted to equity.

This would provide holders with $100 worth of SVW shares (at the time of conversion) and presumably an opportunity to then sell them in the market. Even allowing for some form of discount, it would likely be a reasonable deal, relative to the current price.

7. The company gets into financial difficulty or decides to stop distribution payments.

This seems a low risk outcome. This isn’t Paperlinx, or even Elders, two other companies whose hybrid holders saw the value of their holdings fall precipitously. Gearing for the group remains reasonable and although the underlying businesses are struggling, they continue to make profits. In addition, the large portfolio of listed holdings provides flexibility to all down these holdings, should additional cash be required.

On 21 August 2015, SVW announced they had no intention to change strategy with regard to the SVWPA instruments. We believe the intentions of SVW Board and management to be honourable, and by far the most likely outcome is SVWPA continue to trade on ASX and pay distributions.

The underlying businesses remain profitable, with no need to repay the notes. Having said that, from the point of view of the company, they are trading at a deep discount, they are an expensive form of debt and they are inflexible. As such we cannot rule out an offer from the Company to repay or buy back the securities at a discount to face value. Or perhaps a form of conversion to equity, enabling a simpler capital structure and perhaps an increase in dividends for ordinary shareholders? We do not believe either of these outcomes would necessarily be negative at current purchase prices.

To us, it looks like both ORGHA and SWVPA represent very good risk-weighted debt opportunities. It is likely we will know more on both securities when half-year results are released for the companies later in February. For now, we continue to accumulate at around the prices indicated for each.

Update: On 18 February Origin Energy announced their half-yearly results and reconfirmed their intention to repay the ORGHA notes. As a result, the price increased to over $98.00 and we sold the Fund holding. We may repurchase again in the future if the price reduces to an attractive level again.