WAM Alternative Assets

Key Details

Profile date: March 2025

Manager: Wilson Asset Management (WAM)

Fund: WAM Alternative Assets (ASX: WMA)

Fund Type: Listed Investment Company

Asset Class: Private equity, real assets and private debt.

Investment Strategy: WAM Alternative Assets (ASX: WMA) is a listed investment company focused on giving investors access to non-traditional asset classes.

Affluence Holdings: WMA is currently the largest investment in the Affluence LIC Fund, and it comprises approximately 8% of the portfolio.

Important note: All figures are as at 31 January 2025 and can change significantly over time.

What does WAM do?

Wilson Asset Management are one of the leading LIC managers in Australia, with eight LICs managing over $5 billion for more than 130,000 retail investors. Their LICs offer investors exposure to assets in Australian micro, small, mid and large cap companies, global companies and in alternative assets. Wilson Asset Management was founded and owned by Geoff Wilson, who is one of the leading advocates for the LIC sector.

What is the history of WAM Alternative Assets?

WAM Alternative Assets (ASX: WMA) is a listed investment company focused on giving investors access to non-traditional asset classes.

WMA started life in June 2014 as the Blue Sky Alternatives Access Fund (ASX:BAF). BAF was set up as a feeder fund for retail investors to access the Blue Sky suite of alternative products, through an LIC structure. BAF traded mostly at a premium to NTA from 2014 to early 2018, when the manager of BAF, Blue Sky Alternative Investments Limited (ASX: BLA) was the subject of a short selling attack. This set off a chain of events throughout 2018 and 2019 that culminated in the manager, BLA, entering into Voluntary Administration.

In 2020 after an extended process, Wilson Asset Management was announced as the new manager of BAF. The manager transition was somewhat delayed by the onset of covid. However, in September 2020 investors voted to install WAM as manager. In October 2020 the name was changed to WAM Alternative Assets (ASX: WMA) and WAM formerly took over management.

What is WAM Alternative Assets?

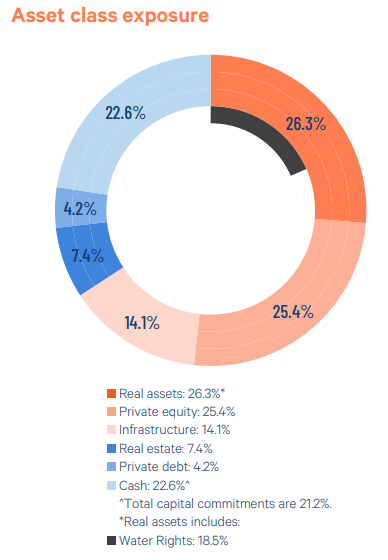

The following graph summarises the current WMA portfolio:

WMA is effectively a fund of funds. They select external managers to gain exposure to various asset classes. Over time the Real assets component of the portfolio has been reducing, and WAM have been diversifying the portfolio into other alternative asset classes.

The manager has changed the portfolio quite substantially from the one they inherited in 2020. The return powerhouse of the strategy is the private equity portfolio. When WAM took over as manager the “vintage” of many investments in the private equity portfolio (when the assets are realised and capital returned to investors) was very similar. This resulted in a bumpy return profile and difficulties in managing cash levels, as many of the investments were realised all at once. The manager has advised that they have worked hard to implement a more staggered approach to vintages, to try to smooth returns and normalise ongoing cash levels.

Since 2020, the portfolio manager has been Dania Zinurova. It was announced in February 2025 that Dania is leaving Wilson Asset Management and will be replaced by Nick Kelly. We have met Nick and believe that he has the appropriate skills to manage the portfolio.

WAM Alternative Assets Performance

The following table shows the underlying portfolio performance since WAM took over management. This performance is based on the change in NTA plus dividends paid to investors to 31 January 2025. This performance is after tax, as LICs are required to pay tax.

| 1 Year | 3 Years | Since Oct 2020 |

| 6.5% | 3.1% | 6.7% |

The underlying performance has been very stable, with the portfolio not suffering any meaningful down periods. While the performance has been a little softer than we would have hoped, once adjusted for tax paid (which eventually becomes franking credits attached to dividends) it is reasonable.

WAM Alternative Assets Trading

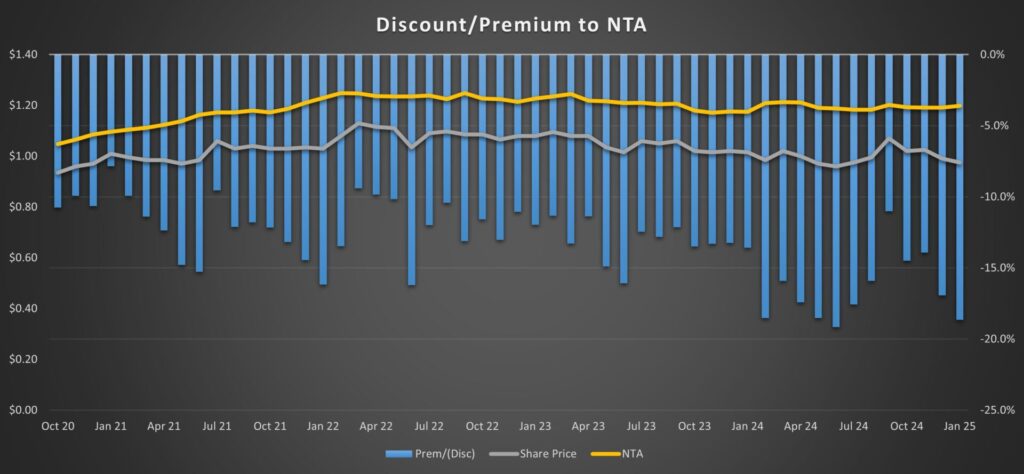

The trading performance of BAF was severely impacted from the first short selling attack, and it began trading at a deep discount to NTA. The discount to NTA peaked at over 40% during the covid period, before improving when it was announced that WAM was appointed as manager.

One of the more important conditions of the change of manager was the inclusion of a “Premium Target” in the Investment Management Agreement, explained as follows:

“During the initial term, if the Company fails to meet the Premium Target on at least three occasions, the Board will propose a special resolution to Shareholders to approve the termination of the New Investment Management Agreement and the liquidation of the Company at the next general meeting of the Company after the fifth anniversary of the Effective Date.”

The below graph shows the discount to NTA since WAM took over in October 2020.

The discount has never gone close to meeting the “Premium Target” under the management agreement. The 5 year anniversary of the initial term is in late 2025. The company has announced that assuming this target is not met beforehand, there will be a vote at the 2025 AGM to give investors the opportunity to wind up the LIC.

The wind up vote is a steep hurdle. It requires 75% of those who cast a vote to vote for a wind up. The LIC (and manager) has already started a “softening up” campaign, outlining reasons why investors should not vote for a wind up. This is to be expected, as the manager would lose substantial fee revenue if the LIC was wound up and money returned to investors.

We believe that some time before the AGM, the manager will commence a substantial marketing campaign to reduce the discount to NTA. With the current discount around 20%, it is much more difficult to convince investors not to vote in favour of a wind up. If the discount can be reduced well into single digits before the vote, it will make the message much easier to accept.

Why we like the Fund

WMA is currently the largest holding in the Affluence LIC Fund. The underlying portfolio has proven to be very stable, and there is an upcoming catalyst later this year in the wind up vote.

WMA offers a listed platform for retail investors to access a diversified portfolio of alternative assets. The portfolio is reasonably attractive, and we don’t believe that the current 20% discount to NTA is deserved. The overall LIC market is currently struggling with discounts, therefore its not surprising that WMA is as well.

The upcoming wind up vote is key differentiator for WMA. We believe the manager will be allocating substantial resources to market WMA to new and existing investors, with the aim of reducing the discount before the AGM. There is a strong story to sell for WMA, and given the portfolios resilience in poor markets, we believe WMA should offer excellent risk adjusted returns from the current price.

We hope that was helpful.

Learn more about the Affluence LIC Fund.

Want to learn more about LICs?

You can download our Listed Investment Companies in Australia Guide

Enjoyed this Investment Profile?

Read our February 2025 profile West Street European Private Credit Fund – Affluence Funds Management

Disclaimer

This Fund Profile was prepared by Affluence Funds Management Limited (Affluence). It was prepared to assist investors in Affluence funds in understanding the investments of the relevant Affluence fund in more detail. It is not an investment recommendation. Prospective investors are not to construe the contents of this article as tax, legal or investment advice. Neither the information nor any opinion expressed constitutes an offer by Affluence, its subsidiaries, associates or any of their respective officers, employees, agents or advisers to buy or sell any financial products nor the provision of any product advice or service.

This Fund Profile does not consider your objectives, financial situation or needs. In deciding whether to acquire or continue to hold an investment in any financial product, you should consider the relevant disclosure documents for that product which are available from the product provider. Affluence recommends you consult your professional adviser before making any decision to invest.