WAM Leaders

Key Details

Profile date: December 2024

Fund: WAM Leaders (ASX: WLE)

Manager: Wilson Asset Management

Investment Type: Listed Investment Company

Asset Class: Australian equities.

Investment Strategy: WLE invests in Australian large cap equities with a stated aim to deliver a stream of fully franked dividends, provide capital growth over the medium-to-long term and preserve capital.

Affluence Holdings: The Affluence LIC Fund currently holds WLE, and it comprises approximately 4% of the portfolio.

Important note: All figures are as at December 2024 and can change significantly over time.

What does Wilson Asset Management do?

Wilson Asset Management are one of the leading LIC managers in Australia, with eight LICs managing over $5 billion for more than 130,000 retail investors. Their LICs offer investors exposure to assets in Australian micro, small, mid and large cap companies, global companies and in alternative assets. Wilson Asset Management was founded and owned by Geoff Wilson, who is one of the leading advocates for the LIC sector.

What is WAM Leaders?

WAM Leaders (WLE) is a listed investment company on the ASX. WLE listed in May 2016 and has undertaken a number of capital raisings and mergers since then. It is one of the larger LICs on the ASX with assets of approximately $1.9 billion. WLE portfolio managers since inception have been Matthew Haupt and John Ayoub.

WLE invests in Australian large cap equities with a stated aim to deliver a stream of fully franked dividends, provide capital growth over the medium to long term and preserve capital. The strategy is very active, with the manager reporting major over and under weight positions compared to the index.

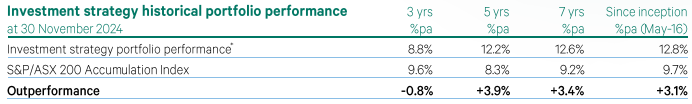

WAM Leaders Performance

WAM Leaders has had a soft 12 months of performance, which has impacted their previously excellent longer term track record. They positioned their portfolio defensively for more difficult market conditions. However, the market accelerated, and their performance lagged as a result.

In particular they were underweight the large banks, including CBA, on valuation grounds (the banks are currently extremely expensive on traditional valuation metrics). While this resulted in underperformance compared to the index, we cannot fault their logic or process.

The above performance figures supplied by WAM exclude all costs and investment management fees. If we have a criticism of Wilson Asset Management, it is their insistence on reporting gross returns. Unless they decide to start offering their investment services for free, and paying the costs of running WLE, there is no justification to report gross returns.

In a recent update, WLE disclosed their largest overweight and underweight positions compared to the ASX200 Index. We would summarise the below as being rationally overweight undervalued companies and underweight overvalued companies. While the currently irrational market is not rewarding this positioning, we believe that patient investors will do well in time.

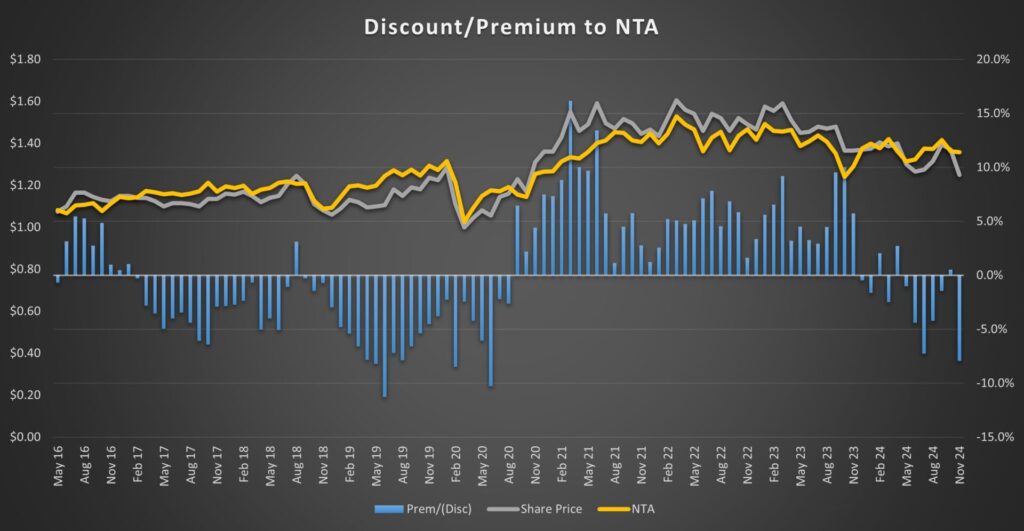

WAM Leaders has traditionally traded well and has spent considerable periods trading at a premium to NTA.

In December, WLE fell to a 10% discount to NTA, and we took the opportunity to increase our position, in what we believe is a rare opportunity for this vehicle.

Why we like WAM Leaders

It is not often we own one of the larger LICs on the ASX. We generally find more opportunities in the small and mid-size LICs as they are less well known and more likely to provide an opportunity for discount capture.

In the current LIC market, even the larger LICs that normally trade at par or a premium such as Australian Foundation Company (AFI), Argo Investments (ARG) and WAM Leaders have all traded at greater than a 10% discount.

We are confident that all three of these larger LICs will revert to par over time, and thus provide an opportunity to outperform the market. However, AFI and ARG are both very similar to the index, and generally provide index like returns over the longer term. This means that their largest holdings are those that we currently believe to be materially overvalued.

WLE strategy is much more active and tilted away from those overvalued stocks that have been powering the market ahead. We believe the combination of a strong management team and material discount to NTA compared to average should result in strong future returns.

Conclusion

At December 2024, WLE is one of the top 10 holdings in the Affluence LIC Fund. We believe the current discount to NTA is very attractive and unlikely to continue indefinitely. In addition we expect underlying performance to outpace the index over the medium term.

We hope that was helpful.

Learn more about the Affluence LIC Fund.

If you enjoyed this Investment Profile, view our November 2024 profile GDI Property Group – Invesment Profile Affluence Funds Management

Want to learn more about LICs?

You can download our Listed Investment Companies in Australia Guide

Disclaimer

This Fund Profile was prepared by Affluence Funds Management Limited (Affluence). It was prepared to assist investors in Affluence funds in understanding the investments of the relevant Affluence fund in more detail. It is not an investment recommendation. Prospective investors are not to construe the contents of this article as tax, legal or investment advice. Neither the information nor any opinion expressed constitutes an offer by Affluence, its subsidiaries, associates or any of their respective officers, employees, agents or advisers to buy or sell any financial products nor the provision of any product advice or service.

This Fund Profile does not consider your objectives, financial situation or needs. In deciding whether to acquire or continue to hold an investment in any financial product, you should consider the relevant disclosure documents for that product which are available from the product provider. Affluence recommends you consult your professional adviser before making any decision to invest.