The Affluence Income Trust now has just over a one year track record. We are very happy with the returns of around 8%, which are ahead of our benchmark of the RBA cash rate plus 3%. Of the total return, 7.7% has been paid to investors as monthly distributions, plus we have seen a small increase in the unit price.

Below, we take a look at the current portfolio and the key criteria we look at when choosing Fixed Income investments.

Portfolio

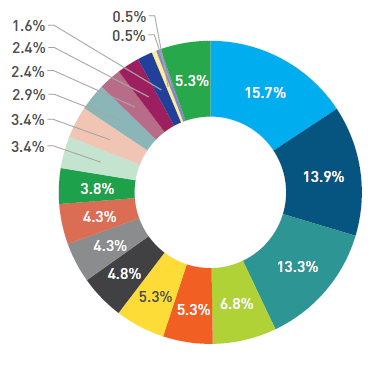

As at 31 August 2024 we have steadily built out the portfolio to 18 underlying investments plus cash. Each segment in the chart below represents an individual investment of the Fund. These are mostly unlisted funds run by specialist fixed income managers, but we also hold some listed fixed income investments for liquidity purposes. Each of these investments, in turn, owns a portfolio of underlying debt investments, providing access to thousands of individual loans.

The portfolio has the following characteristics:

- 3 Funds which each account for greater than 10% of the portfolio (total 43%).

- 3 Funds which each account for greater than 5% of the portfolio (total 17%).

- 7 Funds which each account for greater than 2.5% of the portfolio (total 27%).

- 5 Funds which each account for greater than 0.5% of the portfolio (total 8%).

- Cash of 5%.

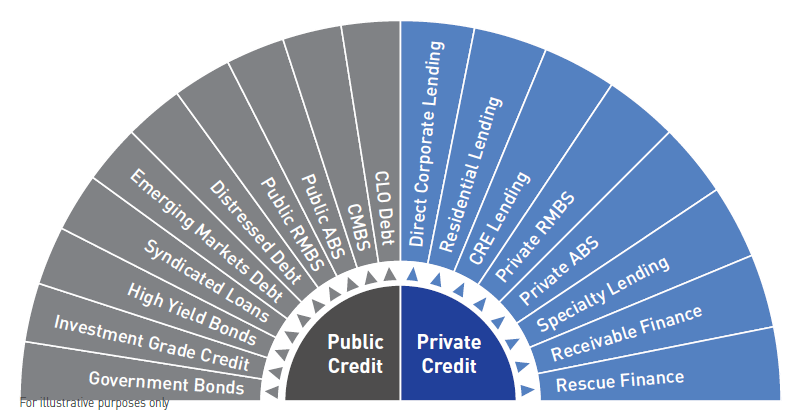

Fixed income investing has come back into vogue over the past two years as interest rates have normalised after being close to zero. This has increased the total returns available, which has led to an increase in the number of options available to investors. Private credit in particular, has seen an explosion in the number of new funds opening to investors. However, this has not necessarily meant an increase in the quality of investment options.

Before starting the Affluence Income Trust, we spent several months undertaking a detailed review of the fixed income sector. In selecting appropriate investments and determining the appropriate position size for an investment, our first consideration is to always remember that in debt investing the expected outcome is usually also the very best possible outcome. Unlike an equity investment, where there could be the potential for strong upside, the maximum return for debt investing is usually for the interest to be paid and the loan amount repaid in full. Thus, upside is limited, but there may be some chance of losses if things go wrong. All of this means that in fixed income investing, risk management is vitally important.

We consider the following criteria when selecting investments:

- Diversification of the investment.

- Manager experience and track record.

- Credit enhancement features.

- Does the sector offer attractive returns.

- Credit risk and can the investment achieve our return target.

Diversification of the investment

When considering diversification, what we are trying to determine is what is the potential loss to the Fund would be if one or more of the largest loans or the largest borrowers defaulted. In simple terms, the less diversified an investment is, the smaller the position size we are likely to have.

Our largest investments tend to hold many different loans with limited concentration risk. While this does not eliminate systematic risk (the risk that an event could negatively impact a whole sector), it does help reduce idiosyncratic risk for the portfolio.

We do hold several investments that are not very diversified. This is often because the manager is still building out their own portfolio. If we like the strategy, manager and risk adjusted returns from this type of investment, we may still invest but it will be a much smaller position size for the Fund. These more concentrated investments tend to be limited to a 2-3% portfolio weighting.

Manager experience and track record

Like most investing strategies, experience extremely important in fixed income. When times are good, and the economy is strong, it can be difficult to differentiate between good deals and bad deals. It’s only when economic times turn bad that the poorer managers get found out. This doesn’t mean that we won’t invest with managers who have had problem loans in the past. Loans can go wrong for a myriad of reasons. However, we look very closely at how managers have coped during tough times. How have they dealt with problem loans? Do they have the skills to take charge and work with borrowers who get into difficulty? Have the outcomes from unexpected defaults been acceptable? Over a few economic cycles, those managers with appropriate risk management skills will rise to the top.

Credit enhancement features

A number of our investments have some type of credit enhancement. This means that there is some feature of the investment that provides additional protection to our capital, in addition to the generally defensive nature of the underlying portfolios. For example, in one of our investments, the manager has taken a 10% first loss position. If there are any loan losses or a shortfall in the cash distribution target occurs, the manager takes the first 10% of losses. This represents a material commitment for the manager, and ensures they are extremely focused from a risk and capital preservation perspective. In another investment, the fund is structured into different tranches with differing return profiles. The vast majority of our investment is in the top ranking tranche, and thus we are provided with a lot of protection before any losses are incurred.

These credit enhancement features normally come at a cost. Usually that means we receive a lower return than would otherwise be possible from the underlying portfolio. We accept this trade off and feel very comfortable having additional downside protection.

Does the sector offer attractive returns?

We always consider whether the sector the investment is in offers attractive risk adjusted returns. For example, currently, we only have a limited allocation to publicly traded bonds and loans. With equity markets at or near all time highs, it’s not surprising that credit spreads (the yield premium above the risk free rate) are very low. This reflects the strong market conditions, but also means that investors are not getting much compensation for taking additional risk in these types of investments.

Credit spreads for traded debt securities are determined by the market and are subject to the same wild swings of human emotion as equity markets. There will be times when credit spreads blow out, and capital values for these loans decrease to reflect an overly pessimistic market view. At that point, our expected returns for these types of investments will be much higher than they are today, and we will probably be aggressive buyers.

Credit risk and can the investment achieve our return target?

Credit risk is the risk of the borrower not performing in line with their obligations, leading to investor losses. Our dual investment objectives are to achieve the target return and preserve capital. Therefore, we are looking for a combination of reasonable returns for a manageable level of credit risk. Much of the fixed income asset class either has low credit risk but unacceptably low returns, or great potential returns but unacceptably high credit risk.

We could easily find many highly diversified funds, potentially with some credit enhancements. However, they may only return a little above the cash rate. As an example, one of the leading ETFs in this space invests in investment grade rated Australian traded debt. The current yield to maturity (what your expected return should be if you hold to expiry) is 5.27% before fees. The ETF has returned approximately 10% over the past 12 months, due to capital gains from the spreads tightening. However, that doesn’t help someone investing today who is effectively buying in at a higher price than they were 12 months ago. We don’t find this level of returns exciting, and therefore these types of investments are not significant in the Fund.

Likewise, we can look at the other end of the spectrum and find many funds that offer potential returns of greater than 10% per annum, have reasonable diversification and may be in a sector we are interested in. This is potentially even more dangerous. There are many ways managers can generate higher potential returns, but the most common is to make riskier loans to more desperate borrowers. Risky loans can deliver tremendous returns and make fixed income investing look like the easiest thing in the world. But if loans go bad and investors lose money, they usually wish they had paid more attention to the risks of the investment. There can be good money to be made from investing in higher yielding loans at certain points in the economic cycle. But certainly not all the time, and probably not at the moment.

Conclusion

We are very happy with the portfolio we have created for the Affluence Income Trust. We believe we have found the correct balance between returns and capital preservation.

However, like all investments, this is not a set and forget portfolio. Markets and investing conditions change, and we will likely need to change the portfolio with them. One of the great strengths of the Affluence Income Trust is its ability to invest anywhere in the fixed income sector. Very few fixed income funds are able to do this.

There will be times when the portfolio looks substantially different to today’s portfolio. However, in the current market conditions, we are confident that the portfolio should continue to perform well.

We hope that was helpful.

Learn more about the Affluence Income Trust.

Want to learn more about Fixed Income?

You can download our Guide to Fixed Income

Disclaimer

This Fund Profile was prepared by Affluence Funds Management Limited (Affluence). It was prepared to assist investors in various Affluence funds in understanding the investments of the relevant Affluence fund in more detail. It is not an investment recommendation. Prospective investors are not to construe the contents of this article as tax, legal or investment advice. Neither the information nor any opinion expressed constitutes an offer by Affluence, its subsidiaries, associates or any of their respective officers, employees, agents or advisers to buy or sell any financial products nor the provision of any product advice or service.

This Fund Profile does not take into account your objectives, financial situation or needs. In deciding whether to acquire or continue to hold an investment in any financial product, you should consider the relevant disclosure documents for that product which are available from the product provider. Affluence recommends you consult your professional adviser before making any decision to invest.