We have rarely seen this many opportunities in the sector.

The Affluence LIC Fund aims to invest in Listed Investment Companies (LICs) that satisfy at least one of these criteria:

- Alpha Generators – LICs that can outperform the market.

- Discount Capture – LICs trading at attractive discounts to NTA.

- Event Driven – Special situations such as corporate actions and other events.

Right now, the market conditions are highly favourable for the Affluence LIC Fund. We are seeing a wide range of opportunities in all three areas. Most of the LICs in our portfolio own investments that are significantly cheaper than the overall market. The average discount to NTA across the portfolio is as cheap as at any time since the Fund commenced. Furthermore, a wide range of LICs have potential corporate actions, including shareholder activism, that can act as catalysts to reduce discounts.

This setup is rare, and in the past when it has occurred, it has led to substantial outperformance relative to the market over the next 1-2 years.

The Affluence LIC Fund’s contrarian approach has been a proven and successful investment strategy for more than 8 years. We invest more when sentiment towards the sector is low, which is the case now. The current market feeling towards LICs is extremely negative, which has us excited. Additionally, June is tax loss season. Investors sell off stocks that have not delivered the expected returns to offset capital gains elsewhere. We have observed that this has a short term negative impact on LICs in June, but they tend to recover in July.

Below, we’ve provided a more detailed explanation of why we believe now is the opportune time to invest in the sector. If your investment portfolio includes an allocation to stocks or equities, we highly recommend you consider initiating or adding to an investment in the Affluence LIC Fund as part of that allocation.

Explaining LICs

The investment universe for the Affluence LICs Fund is the 90 or so LICs listed on the ASX. LICs are listed investment entities.

Like ETFs and managed funds, they are run by an investment manager or investment team that invests in line with an agreed-upon strategy. Unlike ETFs and managed funds, the prices of LICs can diverge quite markedly from their NTA (the value of their underlying investments). This divergence, particularly where individual LICs trade at attractive discounts to NTA, provides us with a significant opportunity to add extra value over and above the returns delivered by the LICs themselves.

Value in LIC portfolios

Our optimism for the Affluence LIC Fund is not just about the NTA discounts.

We also believe that the underlying portfolios of the LICs we hold are significantly cheaper than the overall market. For example, we currently have significant allocations to LICs that invest in ASX small caps, resources, and property. Let’s take a look at why we think all three areas represent exceptional value.

ASX small cap value

Since the start of 2022, smaller companies have significantly underperformed the larger stocks, both on the ASX and in global markets.

In the US, the phenomenon has been driven by the incredible run-up in prices for the Magnificent Seven. In Australia, the traditional market bellwethers of the big four banks and the iron ore miners have driven the index higher.

The graph below, courtesy of Regal Investment Partners, shows the difference in performance between the ASX100 Index, the ASX Small Ords Index, and the ASX Emerging Companies Index. It clearly shows that the smaller the stocks, the more performance has lagged.

We don’t believe this is due to fundamental performance issues. Rather, investors are ignoring small-cap equities. We are firm believers in reversion to the mean. Over the medium term from here, we expect small stocks are likely to outperform the larger indices.

The following graph is based on US data. The same pattern is occurring in the Australian market. Not only are large-cap stocks outperforming, but more specifically, large-cap growth stocks are outperforming.

The biggest underperformers of all are small cap value stocks! This is where we believe the opportunity is.

The Affluence LIC Fund currently has 26% invested in LICs where the underlying portfolio is predominantly ASX small caps. Examples of these holdings include Salter Brothers Emerging Companies (SB2), Ryder Capital (RYD) and the Thorney Opportunities Fund (TOP).

Resources value

A specialist resource investment manager, Terra Capital, recently released a report on why it’s time to invest in resource equities. Their opening comment:

“We often get asked when the best time to invest in both the commodity sector and the Terra Funds is, and the simple answer is when it feels hardest. The sector is a volatile one, and when sentiment is low and commodities are unloved, that has historically provided the best entry point to the fund, and the sector has rarely been less loved than it is currently.”

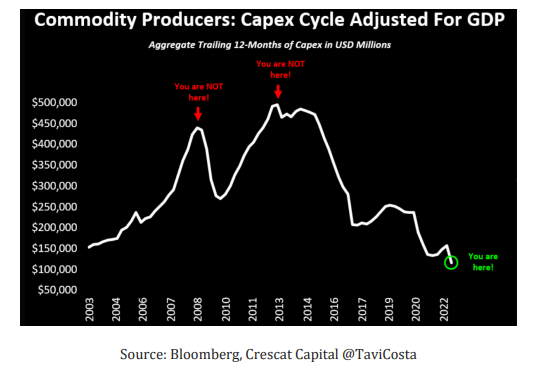

One of the main reasons for their enthusiasm is that capital spending for existing and new mines has been falling for years. For most commodities, producers have been focusing on returning cash to investors, which has come at the expense of developing new mines.

At current prices, we believe the medium to longer term outlook for resource companies is very exciting.

Without new investment, existing supplies will continue to dwindle. Even when capital spending ramps up again, it takes years for a mine site to go from concept to production. In the meantime, this will likely drive commodity prices much higher as demand continues to outstrip supply.

The Affluence LIC Fund currently holds a few LICs that invest exclusively in resources, in addition to several other LICs whose portfolios hold substantial resource exposure. We estimate the current resources allocation within the fund to be approximately 15%.

Listed property

When we first started the Affluence LIC Fund, we always envisaged there might be a time when we would want the flexibility to invest in listed property via real estate investment trusts (REITs).

While not technically LICs, REITs have a similar structure. They are a closed end managed fund with a disclosed NTA and trade at discounts and premiums to their NTA. With a commercial property background, and having worked for a REIT, this is well within our area of competence.

Since early 2022, when interest rates started increasing, REIT prices have plummeted. This has been caused by several factors, but the largest contributor has been the increase in interest rates. We believe that for some REITs, the prices have corrected too far to the downside.

The benefit of investing in REITs is that they generally have a healthy distribution yield. This is especially true at current discount levels. It means that we get paid to wait for the price-to-discount ratio to narrow, which is an added bonus.

At May 2024, the Fund held approximately 7% in REITS, at an average discount to NTA of over 40%.

LIC discounts at cyclical highs?

We love LICs when they trade at big discounts.

It provides the ability to buy assets for less than their intrinsic value and add value for investors through discount capture. What others see as a downside risk, we see as an opportunity for profit.

Many LICs have historically fluctuated between discounts and premiums or between a small and a large discount. This is where the opportunity lies. We don’t need or expect most LIC discounts to disappear entirely. We just need them to get less worse. Given the attractive discounts on offer, reversion to the mean can add substantially to overall returns.

There is another advantage to buying assets at a discount. It magnifies the investment returns. For example, assume an LIC trades at a 20% discount to NTA. If the underlying portfolio produces a net return of 8% on $1.00 of NTA, but it can be purchased at $0.80, then the actual return on the trading price is 10%. As we keep saying, there is profit in discounts

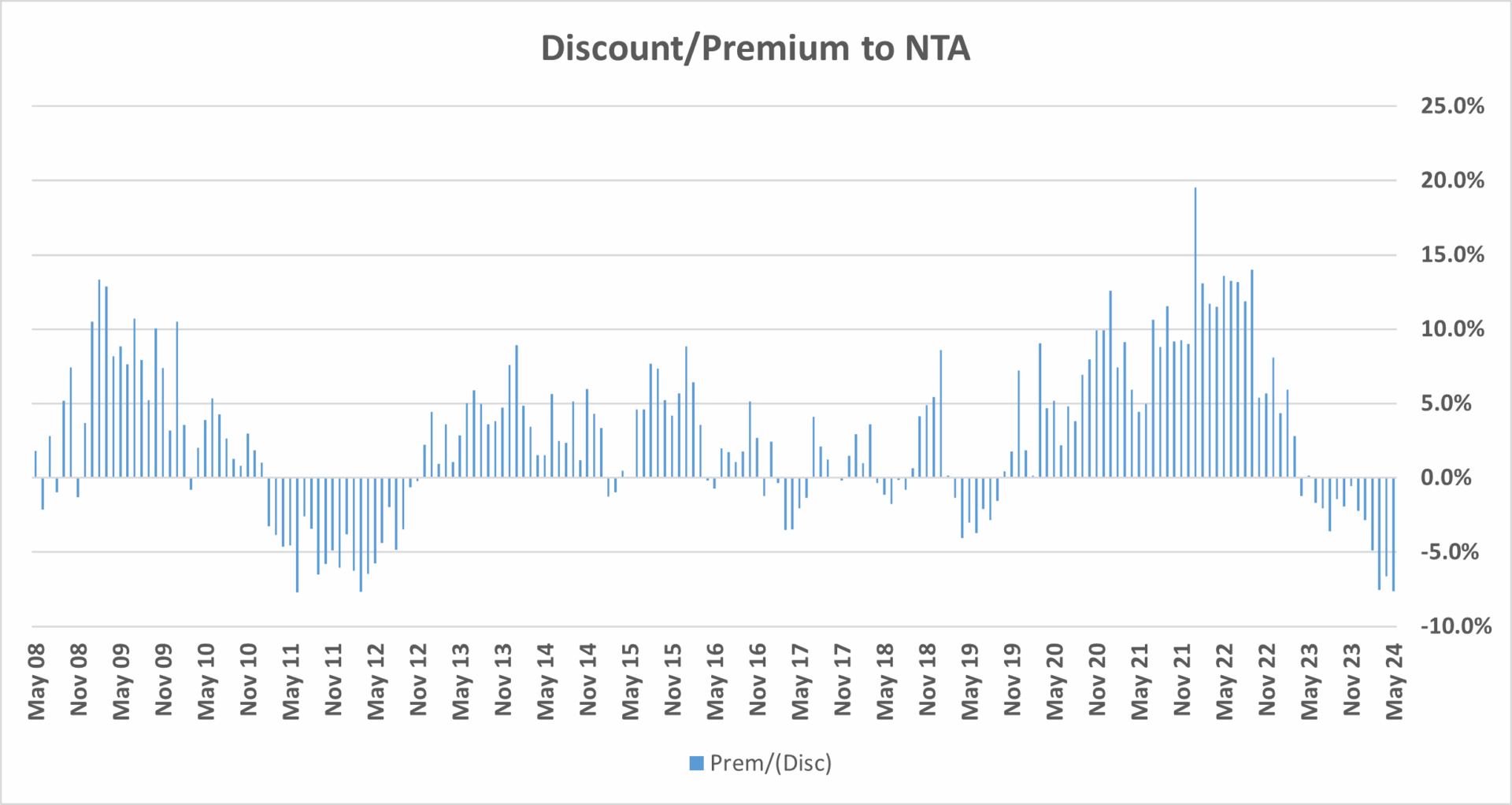

We have tracked the monthly portfolio discount for our Affluence LIC Fund since its inception. This is not an apples-for-apples comparison, as the portfolio changes each month. But it is somewhat representative of the overall LIC market. As you can see below, since February 2024, the average portfolio discount has exceeded the COVID extreme of March 2020.

As one example, the Australian Foundation Investment Company (AFI) is the largest and one of the oldest LICs listed on the ASX. At 30 June, AFI was trading at an 8% discount to NTA. This is the largest discount since 2012 and shows that the current increase in discounts is sector-wide.

Back in February, we wrote extensively about the current status of the LIC market and several reasons why it was so un-loved. But importantly, we are now seeing signs that market sentiment might be starting to improve:

- Interest rates have probably stopped increasing.

- The recovery in large cap and growth stocks should, in time, broaden out to include other assets, including LICs.

- The level of discounts is attracting high net worth and activist investors to the sector.

That last point is important. It has the potential to give LIC managers a hurry up and to force corporate activity on the sector. This will have a positive impact on discounts.

Potential for consolidation and other corporate actions

We have rarely seen a situation where so many LICs are (rightfully) under pressure to deal with the discount problem. Some are taking the hint and dealing with the issue proactively. Others will need a good push-along. And they are likely to get it.

Corporate activity is increasing

Even though discounts have been increasing, there are a variety of corporate actions underway with several LICs to permanently deal with the discount. Over the past 12 months the following corporate transactions have been announced in the LIC sector:

- EAI – Ellerston Asian Investments. Was converted from an LIC into an ETMF after a prolonged period of trading at a substantial discount to NTA.

- PGG – Partners Group Global Income Fund. Listed Investment Trust that converted to an unlisted trust after sustained trading at a discount.

- MGF – Magellan Global Fund. After sustained activist pressure and potential legal action, the manager has announced they are working on a mechanism to convert from an LIC to a structure that will allow investors to exit at close to NTA.

- FOR – Forager Australian Shares Fund. FOR originally started as an unlisted trust before listing in 2016. After a prolonged period of trading at a discount, the manager made the admirable decision to convert from an LIC to a structure that will allow investors to exit for close to NTA.

- NBI—NB Global Corporate Income. Like PGG, this LIT is currently undergoing a transaction to convert to an unlisted trust.

In addition, there are a few more LICs where there have been announcements suggesting future action:

- QVE – QV Equities. QVE and WAM Leaders (WLE) have announced that they have entered into a Scheme Implementation Agreement to merge the two LICs. WLE is effectively taking over QVE, and QVE shareholders will receive new shares in WLE based on an NTA for NTA basis. WLE has a history of trading at part or a premium to NTA, so this is an excellent outcome for QVE shareholders.

- RYD – Ryder Capital. The board and manager have been expressing their displeasure with the continuing discount to NTA for some time. In the latest half year report, they announced a formal strategic review to evaluate various restructuring options. While they stress that there is no assurance of an acceptable outcome, they announced that they will report back to shareholders by August 2024 with the release of the full year accounts.

- SEC – Spheria Emerging Companies. The board has announced a proposal whereby they have set out conditions on whether the company remains an LIC or merges with an existing unlisted fund. Under the proposal, if the average daily NTA discount of SEC over the period 1 October 2024 to 31 December 2024 is at a greater than a 5% discount, the Board of SEC intends to pursue avenues available to enable SEC shareholders to exchange their shares for units in the unlisted fund. This is quite a neat proposal where the market is to determine if shareholders’ investment in SEC should remain in an LIC or convert to interests in a managed fund.

- PMC/PAI – Platinum Capital and Platinum Asia. The boards have announced strategic reviews to deal with the ongoing discounts to NTA. They will likely report back in August when they release their annual report, however there is definitely pressure on them to find a solution.

We believe there will be more corporate transactions to come.

Activists are here, and they will force action

The level of discounts in Australian LICs has not gone unnoticed.

A few international investors have recently taken positions in Australian LICs to take advantage of the above average level of discounts. Like the Affluence LIC Fund, these investors are generally closed ended fund (CEF) specialists who search global markets for opportunities to profit from discount capture. They range from those who are happy to be a little bit patient and let the discounts reduce over time, to the more hostile who are more likely to try and force action to eliminate the discount quickly.

The following LICs have a disclosed substantial investor (greater than 5% of the LIC) who have a track record of forcing corporate action:

- Pengana International Equities (PIA).

- Hearts & Minds (HM1).

- VGI Partners Global (VG1).

- Salter Brothers Emerging Companies (SB2).

We suspect there are others where activist investors are building positions. If an LIC is trading at a sustained discount to NTA, it certainly presents an opportunity for activist investors to force action.

Affluence LIC Fund vs individual LICs

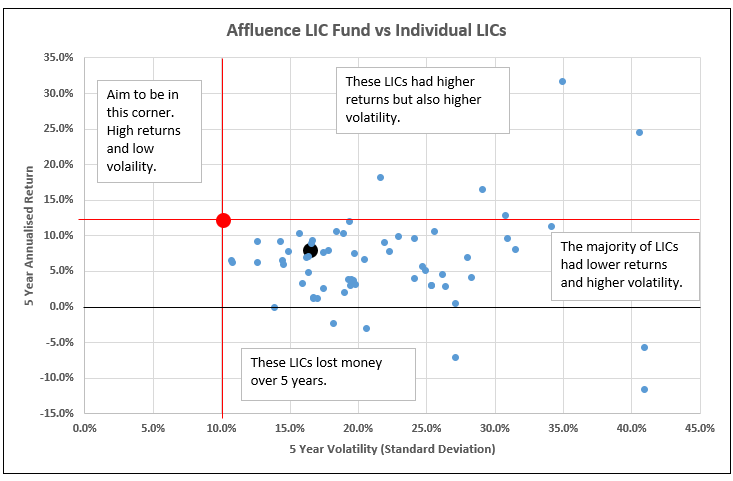

We are specialists in the LIC sector, having run a dedicated fund since 2016. Over this 8+ year period, the Affluence LIC Fund has outperformed the ASX200 Accumulation Index by around 2% per annum.

Just as importantly, the Fund has outperformed the vast majority of individual LICs. In our opinion, there are very few situations where a buy and hold strategy is effective for LICs. Discounts stretch and contract. If we can execute our strategy to profit when discounts are reduced (discount capture), it adds additional returns for investors.

The following graph shows the performance versus volatility of the 62 LICs that we track and have a performance history of at least 5 years. We have also included the Affluence LIC Fund and the ASX200 Accumulation Index. The graph shows the Affluence LIC Fund has outperformed the vast majority of individual LICs over the last 5 years, with much lower volatility.

The Affluence LIC Fund is the Red Dot and the ASX200 Accumulation Index is the Black Dot.

In addition to beating the ASX200, the Affluence LIC Fund has also delivered better returns than 57 of the 62 LICs we track with a 5 year performance history. All five outperformers have done so with significantly higher volatility, meaning it was a much rougher ride, with more ups and downs along the way.

If you invest in LICs directly, please consider the benefits of making an allocation to our Affluence LIC Fund. If you would like to learn more, go to the Fund Page. Here, you can access all the important information about the Fund, including the PDS, TMD and the latest fund reports.

If you have any questions, feel free to contact us.

Want to learn more about LICs?

If you would like to learn more about LICs, you can download our Affluence Guide to LICs here: