Hi,

Australian and global equity markets increased in April and all Affluence Funds were up for the month. Fund reports can be accessed below.

In Australia and the US, labour markets continue to be very strong, with unemployment rates hovering at extreme lows. Consumers and households are continuing to spend and support the economy, with limited signs of economic stress even after aggressive interest rate increases. We continue to be cautious. Monetary policy operates with a lag and we do expect economic conditions to deteriorate eventually, though Australia is much better placed than most other countries. In the meantime, we continue to hold plenty of surplus cash in fund portfolios, and to find attractive investment opportunities which don’t necessarily rely on markets going up to make money.

Applications for the Affluence Investment Fund and Affluence Small Company Fund close on Thursday 25 May. Applications for the Affluence LIC Fund close Wednesday 31 May. Go to our website and click “Invest Now” to apply online or access application and other forms for any of our funds.

Read on to discover how differences in valuations are providing great opportunities for us right now, how the debt ceiling works, why US regional banks matter and what days of the month your investments are more likely to go up.

If you have any questions or feedback, reply to this email or give us a call.

Regards,

Daryl, Greg and the Affluence Team.

Affluence Fund Reports

Affluence Investment Fund

The Affluence Investment Fund increased by 1.1% in April. Since commencing over eight years ago in November 2014, the Fund has returned 7.9% per annum, including monthly distributions of 6.5% per annum.

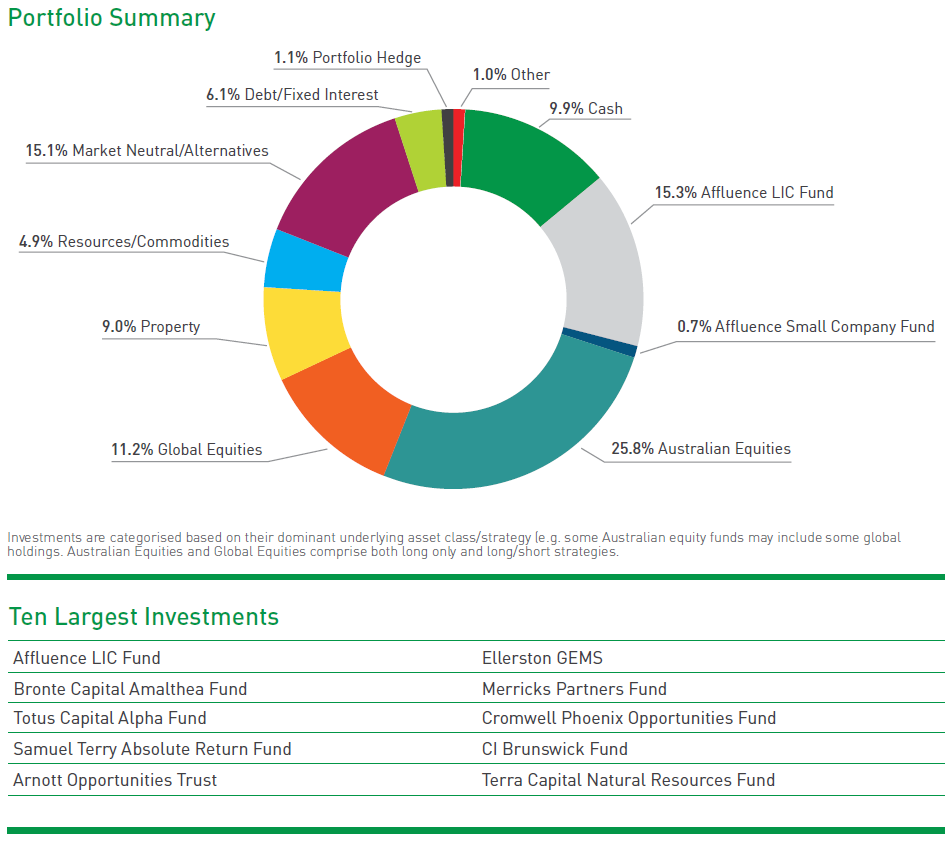

At month end, 63% of the portfolio was invested in unlisted funds, 15% in the Affluence LIC Fund, 1% in the Affluence Small Company Fund, 10% in listed investments, 1% in portfolio hedges and 10% in cash.

The cut-off for monthly applications and withdrawals is Thursday 25 May.

Affluence LIC Fund

The Affluence LIC Fund increased by 0.7% in April. Since the Fund commenced over 6 years ago, returns have averaged 11.4% per annum, including quarterly distributions of 8.0% per annum.

The average discount to NTA for the portfolio at the end of the month was 18%. The Fund held investments in 31 LICs (68% of the Fund), 2% in portfolio hedges and 30% in cash.

The cut-off for monthly applications and withdrawals is Wednesday 31 May.

Affluence Small Company Fund

The Affluence Small Company Fund increased by 2.0% in April. Since commencing in 2016, returns have averaged 9.3% per annum including quarterly distributions of 6.8% per annum.

The Fund held 8 unlisted funds (43% of the portfolio), 8 LICs (14%) and 8 ASX listed Small Companies (19%). The balance 24% was cash.

Available to wholesale investors only. The cut-off for monthly applications and withdrawals is Thursday 25 May.

Invest Differently

The Affluence Investment Fund provides you with access to a wide range of different investment strategies, combining our portfolio construction expertise, with access to over 30 talented boutique investment managers. A significant number of funds in the portfolio can only be accessed directly by wholesale investors, or existing clients of the manager.

We aim for the Affluence Investment Fund portfolio to have an all weather focus – prepared for whatever markets may do. We also tend to skew the portfolio towards the asset classes that we feel are cheapest, and to the themes we think are most likely to impact markets over the next few years. Returns since the Fund commenced have been similar to the Australian share market, with more consistency and significantly better outcomes in falling markets.

With monthly distributions and a performance based fee structure, the Affluence Investment Fund may be a useful diversifier for your investment portfolio.

Things we found interesting

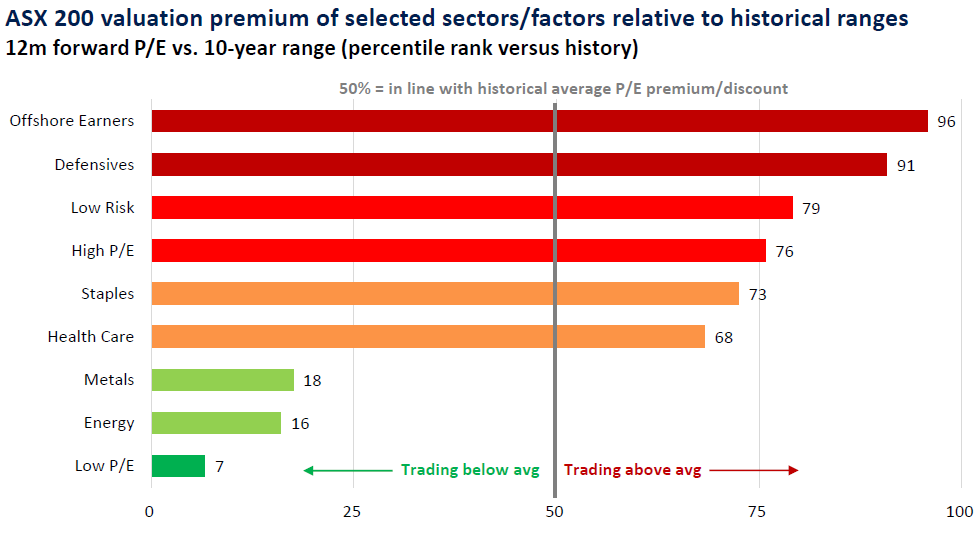

Chart of the month: Relative Valuations.

We deliberately target investments where valuations are cheaper than normal. This chart, courtesy of L1 Capital, illustrates the wide range of current pricing in ASX 200 sectors. In the graph, a value of 100 would mean the sector is the most expensive it has ever been. A 50% value is the historical average. And a value of zero would be the cheapest in history.

As you can see, resources and energy look very cheap. We’ve got reasonable allocations to both those areas in all our portfolios. Low P/E, or value stocks, look even cheaper. That’s our bread and butter, and where a good part of all three fund portfolios are focused. On the contrary, almost all the typical places investors like to hide in a recession, such as consumer staples and defensives, look very expensive relative to history. Buying at such large premiums in the past has generally led to substandard returns. We don’t have much exposure to those areas, instead choosing to hold higher levels of cash and patiently wait.

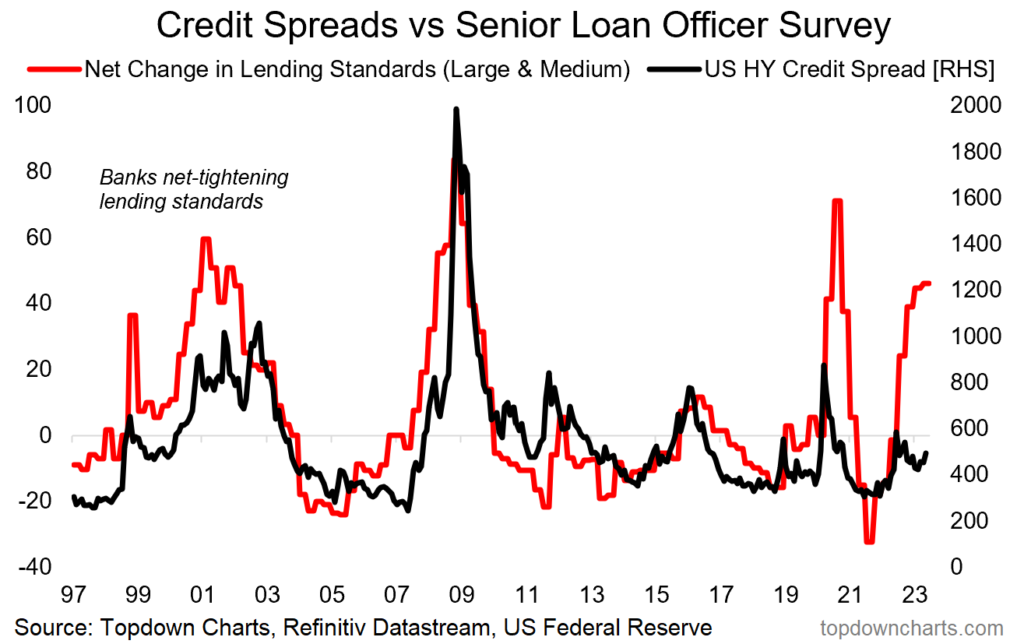

Chart of the month 2: What is SLOOS?

Quite often, the difference between an average recession and a bad one comes down to how well credit continues to flow. The US is starting to look a bit shaky on that score. The graph below shows the historical results of the Senior Loan Officer Opinion Survey (SLOOS), alongside high yield credit spreads. The SLOOS measures whether lending standards are getting tighter or looser. The higher the number, the harder it is to get a loan.

As you can see, in the US loans are getting harder to come by. If that continues, it is likely to eventually result in higher credit spreads. The result is that a lot less loans get made, and when they do, they cost a lot more. This slows down economic growth considerably.

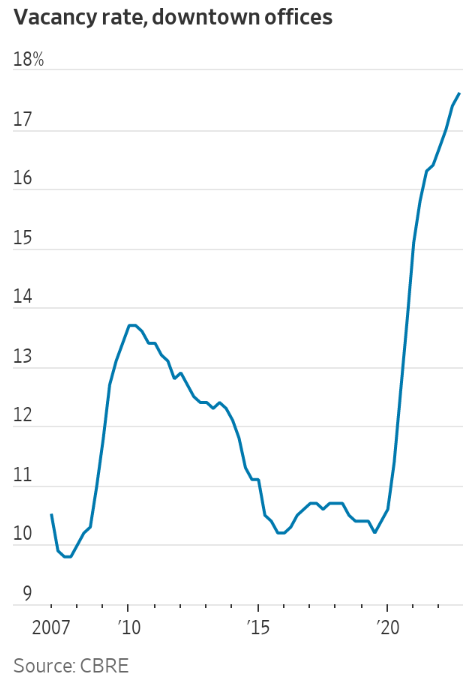

Chart of the month 3: US Commercial Property.

A key reason for the increased difficulty getting a loan is the problems facing US regional banks. We talked a couple of months ago about the failures of SVB and Signature Bank, due to mismatches between short term deposits and longer term bond investments. More recently, another large US regional bank found itself on the precipice of failure and was gobbled up by JP Morgan.

There’s now a new emerging issue with US regional banks that could lead to more widespread problems. Many of these banks have lent a lot of money to local customers, secured over commercial (non-residential) property. In many cases, these loans make up a significant part of the banks’ assets. And right now, commercial property is not going very well. For example, here’s the vacancy rate for US city office buildings. It’s now well above levels seen during the GFC.

So, we know that many US regional banks are having to pay more to retain customer deposits. Now, higher vacancy and a slowing economy mean commercial property valuations are falling, putting pressure on their loan books. This almost certainly means that fewer loans will be made, and the cost to borrowers must go up. A lot. This, in turn, means less buyers for commercial property, leading to further falls in valuations. It can take years to play out fully, and is now a real and significant risk for the US.

Luckily, Australian bank loans are much more focused on residential real estate, with only around 10% of bank lending on commercial property.

This month in history.

In April 1917, in the midst of WWI, the US created the first debt ceiling mechanism. It provided flexibility on the amount of national debt that can be incurred by the US Treasury up to a limit. Before 1917, Congress needed to approve additional debt for each new spending measure it passed.

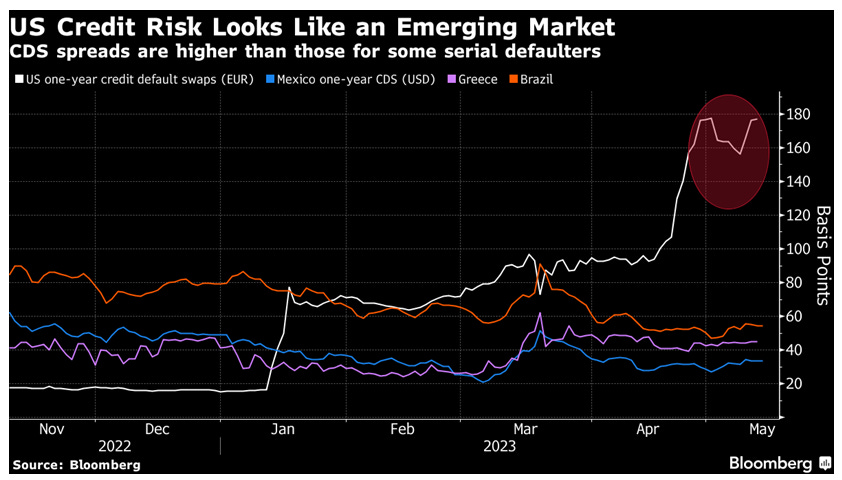

The US debt ceiling has been a popular topic in the financial news this month. The US Federal Government has become rather good at spending more than they earn. Congress has had to lift the debt limit 78 times since 1960. And now, once again, America finds itself approaching the outer limits of the pre-approved credit facility. In recent times, these debt ceiling episodes have led to posturing and brinkmanship by both sides of politics. This creates increasing discomfort for financial markets until the issue is resolved by raising the limit once again. May 2023 is likely to be no different. Below, we can see recent pricing for US credit default swaps, indicating that investors are again uncomfortable with the situation.

Technically, the debt ceiling has already been reached, and the Treasury Department has begun to take what it calls “extraordinary measures” to continue to fund the Government. This is the Government equivalent of putting the mortgage payments on the credit card. Treasury Secretary Janet Yellen has said she expects this funding to entirely deplete in early June, and therefore a solution needs to be found by then. If Congress does not agree to lift the debt ceiling soon, the US government will not have money to pay its bills.

Despite the higher cost of insurance shown above, no one seriously expects the US to default on its debt. But the longer the negotiations take, and more uncomfortable markets become.

Vaguely interesting facts.

In 1916, Adeline and Augusta Van Buren became the first women to travel across the US on motorcycles, despite frequently being arrested for wearing pants.

Great white sharks rarely survive in captivity. Experts suspect it’s because the electricity in buildings interferes with the animals’ electrosensory systems.

Despite producing 95 per cent of the world’s bourbon, the official drink of the US state of Kentucky is milk.

A 21 year old man once saved a woman’s life using CPR he learned watching an episode of The Office.

Road Runner, famously pursued by Wile E Coyote in the Warner Bros cartoons, is a real bird. *

Source: mentalfloss.com, wikipedia.com.

* Roadrunners are a type of cuckoo and are native to Mexico and the southern United States. They can fly but generally try to outrun their prey rather than take flight. While the Road Runner cartoons made the bird famous, they have led to some misconceptions. For example, unlike in the cartoon, real roadrunners don’t say “meep meep”. More importantly, coyotes can run at almost double the speed of a roadrunner. The coyote can outpace the bird by around 30kph, which would make for a very short cartoon.

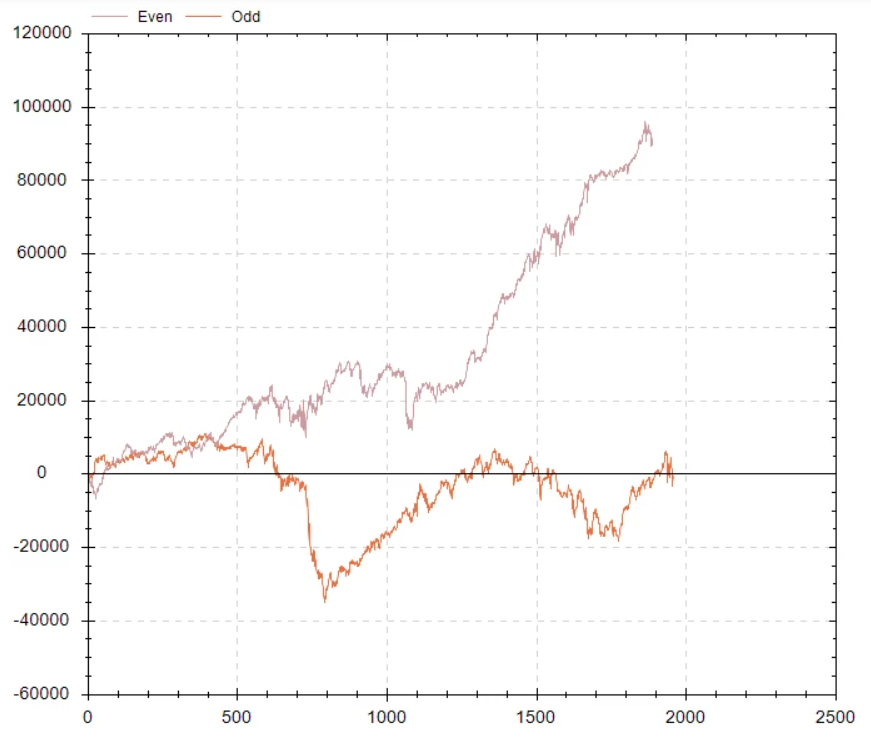

And finally…odds v evens

Sometimes, patterns occur in financial markets that are hard to explain. For example, this data (from Build Alpha with thanks to Topdown Charts) shows that the S&P500 has performed much better on even days than odd days.

Thanks for reading. If you enjoyed this newsletter, forward it to a friend.

If you are that friend, you can subscribe and see previous newsletters here.

Got a question?

If you want to learn more about our Funds or invest with us, the buttons below will take you to the right places.

If you want to catch up on earlier versions of our monthly newsletter, you can view them here.

If you have a question, you can email or call using the details below, or simply reply to this email and we will be in touch with you as soon as we can.

Our Funds Invest Now Contact Us

P: 1300 233 583 | E: invest@affluencefunds.com.au | W: affluencefunds.com.au

This information has been prepared by Affluence Funds Management Limited ABN 68 604 406 297 AFS licence no. 475940 (Affluence) as general information only. It does not purport to be complete, and it does not take into account your investment objectives, financial situation or needs. Prospective investors should consider those matters and read the Product Disclosure Statement (PDS) or Information Memorandum (IM) offering units in the relevant Affluence Fund before making an investment decision. The PDS or IM for each Affluence Fund contains important notices and disclaimers and important information about each offer.

As with all investments, an investment in any Affluence Fund is subject to risks. If these risks eventuate, they may result in a reduction in the value of your investment and/or a reduction or cessation of distributions. Distributions are not guaranteed, nor is the return of your capital. Past performance is not indicative of future performance. It is important that you know that the value of your investment will go up and down over time, returns from each Fund will vary over time, future returns may differ from past returns, and returns are not guaranteed. All of this means that you could lose money on an investment in an Affluence Fund. As set out in the PDS or IM for each Affluence Fund, key risks include concentration risk, economic and market risk, legal and regulatory risk, manager and key person risk, liquidity risk, leverage risk and currency risk. Affluence aims, where possible, to actively manage risks. However, some risks are outside our control.

This information and the information in the PDS or IM are not recommendations by Affluence or any of its officers, employees, agents or advisers. Potential investors are encouraged to obtain independent expert advice before making any investment decision.