This article was originally published on Livewire.

Right now, no one likes LICs. In fact, given the apparent apathy towards them by investors, we would go as far as to say they are actively unliked. And this makes us very excited. Are LICs the most unloved they have ever been?

Recent Market Dynamics

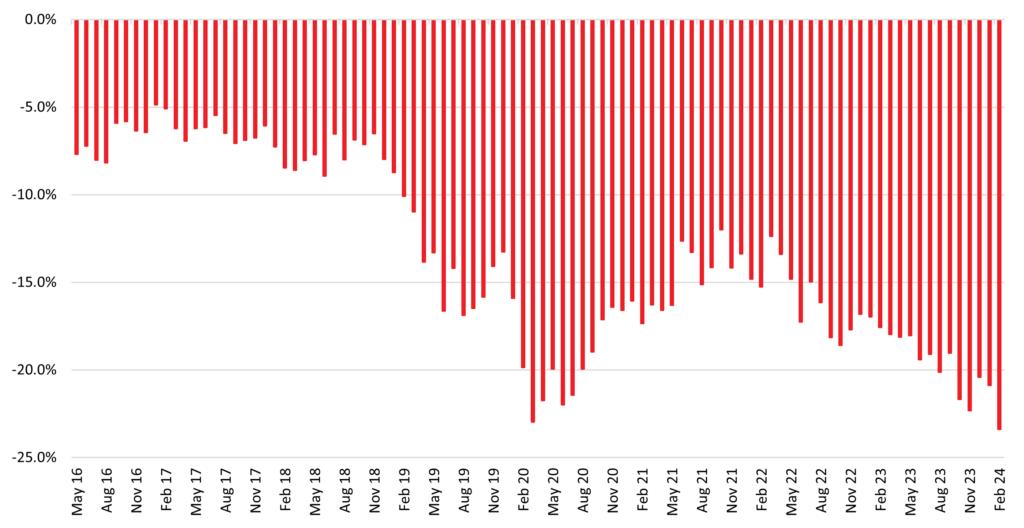

While every LIC is subject to its own individual circumstances, there is no doubt that LICs are in a funk. Their popularity, using discounts to NTA as a proxy, have never recovered from the sell off caused by Labor’s pledge to stop franking credit refunds in 2018. There were signs of a recovery after Labor repealed their election pledge, and then lost the 2019 election, until covid occurred in 2020 and all asset classes sold off. Again, discounts slowly decreased after the covid crisis as markets recovered until central banks started increasing interest rates. Since 2022 equity markets have been more volatile, but many global equity markets have still managed to hit new all time highs since. And since interest rates have increased, discounts to NTA have widened again.

Discounts at historic highs

We have tracked the monthly portfolio discount for our Affluence LIC Fund since inception. While this is not an apples for apples comparison as the portfolio changes each month, it is still representative of the overall market. And as at the end of February 2024 the portfolio discount has exceeded the covid extreme of March 2020, even though the ASX200 Index, S&P 500 Index, Japanese and European equity markets have hit all time highs.

While there is no single reason for the increasing discounts, we believe the following factors have all contributed:

Fixed income is providing an alternative.

Many retail investors have traditionally invested in LICs for income, viewing the franked dividends attractively. Most LICs have continued paying out circa 5% franked dividends (6.5% when grossed up). However, given the 4.25% increase in the RBA cash rate there are now genuine alternatives from fixed income investments. Depending on the level of risk an investor is willing to take, income yields of 5-10% are now achievable from fixed income, and often with lower volatility and risk. On the flipside, fixed income alternatives don’t have the same upside potential as LICs. If, and when the RBA reduces the cash rate, most fixed income investments will reduce in yield as well. This is likely to progressively see a rotation back to LICs for income.

Exchange traded ETFs are taking market share.

Thanks to a change in listing rules and new structures, many equity strategies can now be listed on the ASX as a managed ETF. Traditionally, ETFs were limited to index funds where only those strategies that tracked a major index could be accepted. Now actively managed portfolios, including long/short funds and more sophisticated strategies can be purchased through an ETF structure. The major reason investors may prefer these structures over an LIC is because they can be bought and sold at very close to NTA, thereby eliminating the risk of discounts. There has been a huge increase in the number of managers offering their strategies through this structure. Some investors who previously would have invested in an LIC, now invest in these structures instead, thereby reducing the demand for LICs. There are limitations on the assets and strategies that can work in the actively managed ETF structure, so ETFs will never negate the need for LICs.

A bifurcated market means LICs are being ignored.

This isn’t limited to just LICs. Market in general appear to be much more bifurcated between the popular and the completely ignored, to an extent we have rarely witnessed before. There have been countless articles written about the Magnificent Seven, and how their incredible performance has pushed them to extreme levels of concentration in the S&P500. Putting to one side whether their performance is justified, it is the most extreme example of investors chasing the most popular investments and ignoring everything else. This pattern is currently being repeated in a wide range of markets, for example large cap versus small cap equities, industrial versus resources equities, and a general mania for anything AI related. This reporting season has seen many excellent results from LICs, small cap equities and REITs that the market has completely ignored. For the time being, the market has no interest in any investment that is not in the “hot sectors”.

Reporting Season Trends

In general, reporting season for LICs is not as meaningful as it is for an operating company. LICs are required to report their NTA at least once per month, and these days many LICs report daily or weekly NTAs in line with best practice.

However, there are a few takeaways from the recent LIC results:

Profit reserves are growing.

Given the fairly buoyant market conditions, the majority of LICs reported a healthy profit reserve, giving them dividend coverage for a few years into the future. While this doesn’t increase the intrinsic value of an LIC, it is important from a marketing perspective that they can continue to payout dividends to shareholders.

LIC boards are not tackling discounts in any meaningful way.

As Basil Fawlty said, “don’t mention the war”. Unfortunately, the vast majority of LIC managers either glossed over their embedded discounts to NTA, or even worse, didn’t mention them at all. Some gave vague statements of working to get rid of unjustified discounts, without suggesting how they were going to achieve it. This is creating a big opportunity for activist investors to take positions in individual LICs and agitate for change.

On-market buy backs.

Almost every LIC has an on-market buy back active, where the LIC purchases shares on market and then cancels them. In the vast majority of cases, this is done in a haphazard and immaterial way, which has proven to have no meaningful impact on the prevailing discount. We do believe that buybacks are a good idea if done at scale. If an LIC can purchase their shares back at say a 15% discount, that means they are getting a risk and tax free return of 15%, which in most cases is far in excess of what they could achieve through investing. Both VG1 and RG8 gained approval at their last AGMs to purchase up to 25% of their outstanding shares over a 12 month period. This increased level of buy backs does appear to have helped reduce the discount, and this is an excellent use of the LICs capital.

The activists are here

The level of discounts in Australian LICs have not gone unnoticed. There are now a number of local and international investors who have taken positions in Australian LICs to take advantage of the above average level of discounts. These investors are generally closed ended fund (CEF) specialists, who search global markets for opportunities to profit from discount capture (additional profit when a discount reduces or is eliminated). They range from the more passive investors who are happy to be patient and let the discounts reduce over time, to the more hostile who are more likely to try and force a windup to get their capital back at NTA.

The following LICs have a disclosed substantial investor (greater than 5% of the LIC) who have a track record of forcing corporate action:

- Pengana International Equities (PIA).

- QV Equities Limited (QVE).

- Hearts & Minds (HM1).

- VGI Partners Global (VG1).

- Salter Brothers Emerging Companies (SB2).

Corporate Activity

Even though discounts have been increasing, there are corporate actions underway to permanently deal with discounts to NTA.

Over the past 12 months the following corporate transactions have been announced in the LIC sector:

- EAI – Ellerston Asian Investments. Was converted from an LIC into an ETMF after a prolonged period of trading at a substantial discount to NTA.

- PGG – Partners Group Global Income Fund. Listed Investment Trust that converted to an unlisted trust after sustained trading at a discount.

- MGF – Magellan Global Fund. After sustained activist pressure and potential legal action, the manager has announced they are working on a mechanism to convert from an LIC to a structure that will allow investors to exit at close to NTA.

- FOR – Forager Australian Shares Fund. FOR originally started as an unlisted trust, before listing in 2016. After a prolonged period of trading at a discount, the manager made the admirable decision to convert from an LIC to a structure that will allow investors to exit for close to NTA.

- NBI – NB Global Corporate Income. Similar to PGG, this LIT is currently undertaking a transaction to convert to an unlisted trust.

In addition, there are a few more where there have been announcements suggesting future action:

- QVE – QV Equities. WAM Leaders (WLE) announced an intention to launch a takeover of this LIC. While they have not officially made an offer yet, this announcement did trigger the QVE board to launch a strategic review. Given that WAM Strategic Value (WAR) currently owns 15% of QVE, we believe there is a very high probability that either a WAM takeover will occur or investors will be provided with an option to exit much closer to NTA.

- RYD – Ryder Capital. The board and manager have been expressing their displeasure with the continuing discount to NTA for some time. In the latest half year report, they announced a formal strategic review to evaluate various restructure options. While they stress that there is no assurance of an acceptable outcome, they announced that they will report back to shareholders by August 2024 with the release of the full year accounts.

- SEC – Spheria Emerging Companies. The board has announced a proposal whereby they have set out conditions on whether the company remains an LIC or merges with an existing unlisted fund. Under the proposal, if the average daily NTA discount of SEC over the period 1 October 2024 to 31 December 2024 is at a greater than a 5% discount, the Board of SEC intends to pursue avenues available to enable SEC shareholders to exchange their shares for units in the unlisted fund. This is quite a neat proposal where the market is to determine if shareholders’ investment in SEC should remain in an LIC or convert to interests in a managed fund.

Why we are excited

Many investors don’t like LICs because they can trade at discounts. This brings with it the risk that good performance by an LIC can be lost through the discount increasing. However, we love LICs for this exact reason. The ability to buy assets for less than their intrinsic value and add value through discount capture. What others see as a downside or risk, we see as an opportunity for profit.

There are many LICs that have historically fluctuated between discounts and premiums, or a small discount and a large discount, and this is where the opportunity lies. We don’t need or expect most LIC discounts to revert to par. Given the current extreme level of discounts, reversion to the mean will add substantially to overall returns.

There are other advantages in buying assets at a discount. Assume an LIC trades at a 20% discount to NTA (less than the overall discount of our portfolio). If the underlying portfolio produces a net return of 10% on $1.00 of NTA, but it can be purchased at $0.80, than the actual return on trading value is 12.5%. As we keep saying, there is profit in discounts!!!

In many cases, the assets the LIC itself owns are also cheap. This provides a “double discount” scenario, where the investments an LIC holds are showing very good value, and they are also trading at an attractive discount, providing the ability to profit In two ways.

Summary

All markets move in cycles, and the LIC market is no different. Our expectation is that as activist investors methodically work their way through the sector, forcing individual LICs to either convert structures or wind up, more investors will realise the value on offer in LICs and a normalisation period will occur. Its impossible to predict the timing of this, but given the already extreme levels of discounts we believe its likely sooner rather than later.

In the meantime, the discount effect of amplifying underlying portfolio returns provides a solid base. In addition, there are still discount capture opportunities available in the existing corporate actions, while we wait for the sector normalisation to occur.

Want to know more?

We encourage you to do your research before investing in any LIC. If you would like to learn more, here are some of other articles on LICs: