Hi,

February was dominated by the tragic events in Ukraine. This caused global stock markets to fall approximately 5% on average, following January’s losses. While the Australian equity market increased by 2.1%, there was a wide range of results under the surface. Commodities saw strong increases while the previous high flying tech names tumbled.

Volatility has continued to be high due to the combination of rocketing commodity prices, ongoing anxiety regarding a global conflict and the potential for higher and more sustained inflation. The US Federal Reserve has just started raising interest rates and in the coming months will stop its quantitative easing program. Both actions represent reversals of the easy monetary conditions that have seen asset prices boom.

Markets have stabilised somewhat in the last few days. However, we continue to remain cautious. We expect further volatility during the year and we continue to hold more cash than usual in all funds.

If you want to apply online or download application or withdrawal forms for all our funds, go to our website and click “Invest Now”.In other news this month, we take a look at commercial property yields, explain why we like resources stocks, take a look at flying cars and examine the maths behind your Powerball chances.

If you have any questions or want to give us some feedback, you can reply to this email or give us a call.

Regards.Daryl,

Greg and the Affluence Team.

Affluence Fund Reports

Affluence Investment Fund

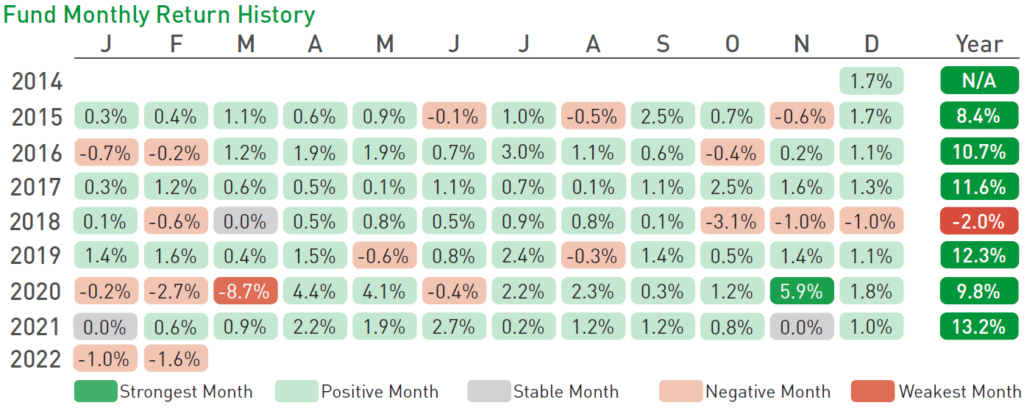

The Affluence Investment Fund returned -1.6% in February. Since commencing in 2014, returns have averaged 8.6% per annum, including distributions of 6.6% per annum.

At month end, 58% of the portfolio was invested in unlisted funds, 14% in the Affluence LIC Fund, 12% in listed investments, 2% in portfolio hedges and 14% in cash.

The cut-off for monthly applications and withdrawals is 25 March.

Affluence LIC Fund

The Affluence LIC Fund returned -1.4% in February. Since commencing in 2016, returns have averaged 13.0% per annum, including quarterly distributions of 7.4% per annum.

The average discount to NTA for the portfolio at the end of the month was 15%. The Fund held investments in 24 LICs (73% of the Fund), 5% in portfolio hedges and 22% in cash.

The cut-off for monthly applications (existing clients only) and withdrawals is 31 March.

Affluence Small Company Fund

The Fund was flat in February, as was the ASX Small Ords Index. The Fund holds a range of value investments focused on smaller companies. Since commencing in 2016, returns have averaged 10.0% per annum.

The Fund held 8 unlisted funds (52% of the portfolio), 7 LICs (16%) and 6 ASX listed Small Companies (18%). The balance 14% was cash and hedges.

Available to existing wholesale clients only. The cut-off for monthly applications and withdrawals is 25 March.

25+ talented fund managers in a single investment

The Affluence Investment Fund provides access to over 25 boutique fund managers in a single investment. These underlying managers all have several things in common. A lot of experience, an accomplished investment track record, and a specialised investment strategy. Plus, they all invest a significant portion of their own money in the strategies they manage.

You may not have heard of many of these funds. Quite a few are closed to new investors, or only available to wholesale clients. Almost all of them specifically cap the amount of money they manage, because they understand that one of the biggest barriers to exceptional performance is too much money.

Through the Affluence Investment Fund, you can access them all, plus more. With monthly distributions, a focus on investing differently and fees based only on performance, the Affluence Investment Fund is probably unlike anything else in your investment portfolio.

Things we found interesting

Chart of the month.

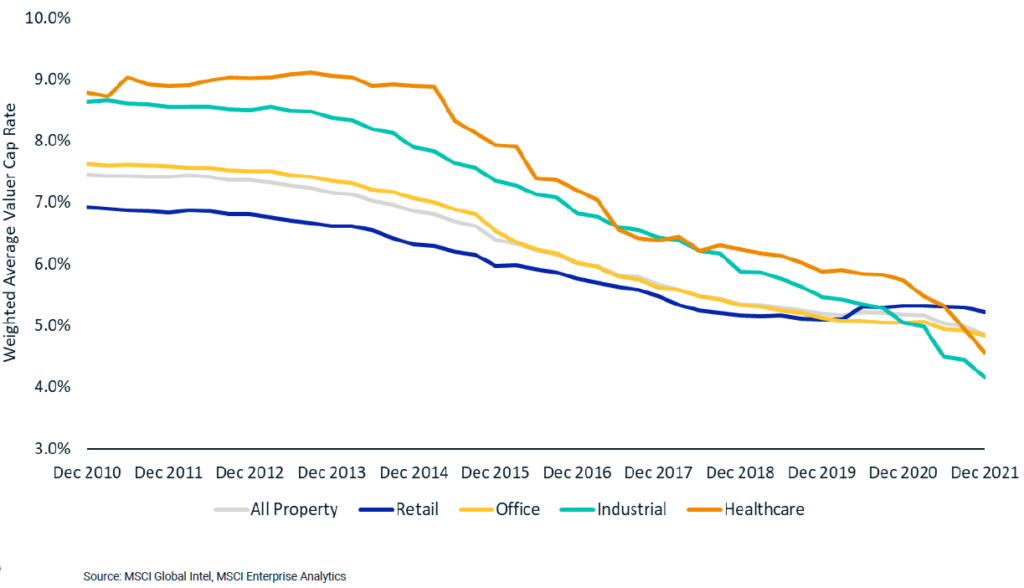

It seems that Australian commercial property (shopping centres, office buildings and industrial sheds) have never been more popular. And yet, they have probably rarely, if ever, been more expensive. The chart below shows average cap rates (yields) for various types of commercial property in Australia since 2010. The data comes from MSCI and covers a large proportion of all investment grade property in Australia.

Lower yields translate to more expensive valuations. For example, an office building with an annual rent of $1 million would have been valued at $13.3 million back in 2010, at an average yield of 7.5%. Right now, investors would be prepared to accept a yield of around 5% for the same asset. That means that at that same rent, it would now be valued at $20 million.

That’s a 50% increase in value, entirely due to investors being prepared to accept a lower return. It’s why investors, including us, have done very well out of property investments over the past few years. For industrial buildings and healthcare assets such as hospitals and medical centres, the change has been even starker.

A big part of the reason for the yield change, and hence the upside, has been falling interest rates. After all, just like residential property, if you can borrow at ever lower rates, you can afford to pay more.

We think that trend is now over. We’ve been steadily lowering our exposure to property investments in the Affluence Investment Fund over the past few years. Back in 2015, it was as high as 25% of the Fund. Now, around 8% of the portfolio is property holdings. Of that 8%, over half is invested in listed REITs that own shopping centres and trade at a discount to their underlying value. At current prices, there’s very little else that excites us about commercial property.

It’s possible that in a rising interest rate market, yields will start to increase again. And if that happens, it will dampen returns substantially. This is particularly the case for property funds with high levels of gearing.

Chart of the month 2.

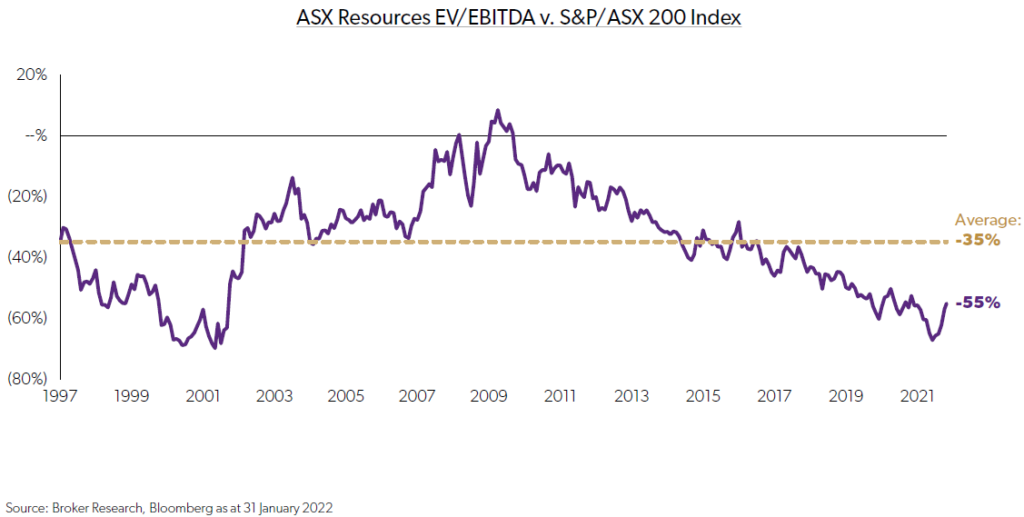

One area we’ve been continuing to increase our exposure to gradually is resources. Here’s just one chart, from fund manager Regal, which explains why.

The chart compares resource stock valuations to the ASX200 Index and shows that discounts for resource companies are much higher than usual. This is just one part of the reason we are excited by the resources sector at the moment. The prices for many commodities have rocketed higher in the last year, even before the Ukraine conflict. The prices of listed miners have not kept pace. The longer commodity prices remain elevated, the more likely it is that we see big increases in the prices of resource stocks.

There are many reasons why we believe higher commodity prices are here to stay. They include higher demand (due to a range of factors), constrained supply, and the time it takes to bring new projects to market.

The one big risk we see is cost inflation. While resource prices are going up, the cost to produce them is starting to increase as well. Those cost increases have the potential to be substantial. And while that might limit the upside, for now, it’s another reason why higher spot prices are probably here to stay.

If you’re interested, two great presentations have recently been released from Tribeca and Regal which explain the potential a lot better than we can. You can access them here and here.

Chart of the month 3.

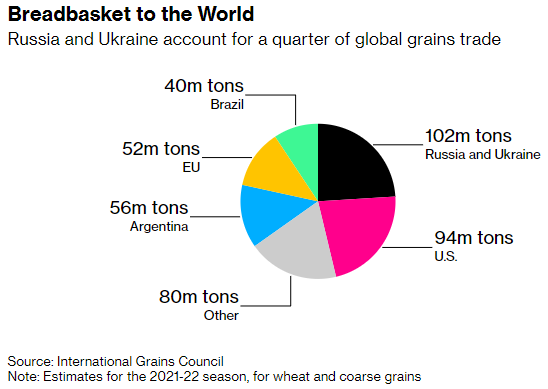

The Russia/Ukraine conflict has undoubtedly had a large impact on the prices of many resource commodities. But there’s a bigger, and potentially much more disastrous impact. In the past few weeks, the prices of many agricultural commodities have skyrocketed. As one example, the chart below shows the big players in the global grains trade.

As you can see, Russia and Ukraine combined account for one quarter of all trade.

The UN Food & Agriculture Organisation Food Price Index has risen by over 30% since the start of the year. And it can potentially get much worse. The biggest impacts are likely to be felt in developing nations, particularly Africa and parts of Asia. That, in turn, could mean the humanitarian crisis spreads from Ukraine to many other countries.

Quote of the month.

“You and I, and everyone else, and the smartest people that we know have no clue what’s going to happen over the next 10 years. That’s always been true and I think it always will be true.”

Morgan Housel

Morgan Housel is an exceptional financial and investment writer. Here is a link to a recent podcast with Tim Ferriss. You can also find a bunch more quotes, plus links to his latest book (The Psychology of Money) and a variety of other interesting stuff.

This month in (financial) history.

In March 2000, the writing was on the wall as investors begin rotating out of the Internet and into Old Economy stocks. On 15/16 March, the Dow Jones Industrial Average surged 8.35% in two days. For the first time ever, investors turned over more than 500 million shares just in the first hour of New York Stock Exchange trading.

“Things that used to take weeks to happen now happen in days,” marvels Bill Schneider, head trader at Warburg Dillon Read.

In March 1963, the final (original) episode of the Jetsons animated cartoon aired. The Jetsons were a futuristic family and the show was produced by Hanna-Barbera, creators of The Flintstones. Just 24 episodes were made. Unfortunately, the show was scheduled opposite Walt Disney’s Wonderful World of Color and Dennis the Menace and did not receive much attention, so was cancelled after one season. Re-runs were moved to Saturday mornings, where it was very successful for many years. The show was eventually rebooted in the 80’s. Production stopped again in 1989, as the majority of the core cast (George O’Hanlon, Mel Blanc and Daws Butler) sadly died in 1988 and 1989.

The coolest thing about the Jetsons was their flying car. Those of us who are old enough can probably remember the sound it made (go on – we dare you to make that sound!). Tesla founder Elon Musk has said publicly that they are working on a flying car. But Swedish company Jetson has beaten them to it. And if we were ever going to spend $92,000 on a car (we’re not) it would be this one.

More on the story of the modern day Jetson flying car is here.

You can watch the launch video here.

Once you’ve seen it, you WILL want one.

And if you can’t remember what the original cartoon car sounded like, the Jetsons cartoon theme song is here.

In March 1933, President Franklin D. Roosevelt takes the U.S. off the gold standard, removing the yellow metal from coinage and circulation, even banning it as a collectible.

Vaguely interesting facts.

The world’s deepest underwater mailbox is installed just off the shore of Susami, Japan.

Adjusted for inflation, the highest-grossing movie of all time is Gone With the Wind, earning approximately $1.8 billion.

According to a study, most dogs reach peak cuteness between six and eight weeks old. No word on who paid for this study.

Louis Braille was just 12 years old when he began transforming a method of silent communication used by the French military into a language that allows blind people to read.

There are approximately 200 feral cats roaming the grounds of Disneyland, where they help control the park’s rodent population. The staff provide them with extra food and medical care.

Source: mentalfloss.com

And finally…should you play Powerball?

You might be pleased to know that we are not gamblers at Affluence, and so our short answer to the above question is a resounding “no!”.

For a longer answer, you might be interested in this piece, from blogger Thomas the Think Engine, who takes a close look at the Powerball odds. Spoiler alert, the answer is still no. But if you’re vaguely interested in the maths, then it’s worth a read.

If you enjoyed this newsletter, forward it to a friend.

Got a question?

If you want to learn more about our Funds or invest with us, the buttons below will take you to the right places.

If you want to catch up on earlier versions of our monthly newsletter, you can view them here.

If you have a question, you can email or call using the details below, or simply reply to this email and we will be in touch with you as soon as we can.

Our Funds Invest Now Contact Us

P: 1300 233 583 | E: invest@affluencefunds.com.au | W: affluencefunds.com.au

This information has been prepared by Affluence Funds Management Limited ABN 68 604 406 297 AFS licence no. 475940 (Affluence) as general information only. It does not purport to be complete, and it does not take into account your investment objectives, financial situation or needs. Prospective investors should consider those matters and read the Product Disclosure Statement (PDS) or Information Memorandum (IM) offering units in the relevant Affluence Fund before making an investment decision. The PDS or IM for each Affluence Fund contains important notices and disclaimers and important information about each offer.

As with all investments, an investment in any Affluence Fund is subject to risks. If these risks eventuate, they may result in a reduction in the value of your investment and/or a reduction or cessation of distributions. Distributions are not guaranteed, nor is the return of your capital. Past performance is not indicative of future performance. It is important that you know that the value of your investment will go up and down over time, returns from each Fund will vary over time, future returns may differ from past returns, and returns are not guaranteed. All of this means that you could lose money on an investment in an Affluence Fund. As set out in the PDS or IM for each Affluence Fund, key risks include concentration risk, economic and market risk, legal and regulatory risk, manager and key person risk, liquidity risk, leverage risk and currency risk. Affluence aims, where possible, to actively manage risks. However, some risks are outside our control.

This information and the information in the PDS or IM are not recommendations by Affluence or any of its officers, employees, agents or advisers. Potential investors are encouraged to obtain independent expert advice before making any investment decision.