Large cap stocks lag

Given the amount of negative news in the last three months of the 2016 financial year, you’d be forgiven for thinking it was a terrible time in the markets. In reality, the ASX200 (including dividends) rose by 3.9% during the June quarter.

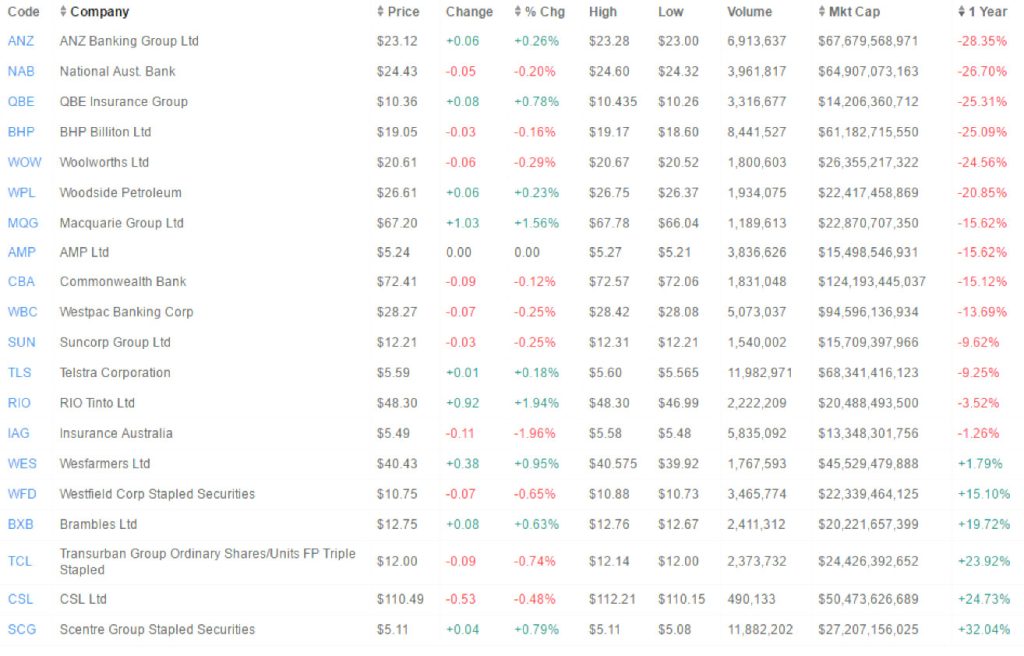

For the year ended June 2016, the ASX200 index rose by 0.6% including dividends. It fell by 4.1% excluding dividends. But this headline performance hid a very ugly story for large-cap stocks. The ASX20 index fell by 7.0% for the year ended June 2016 including dividends, or negative 11.9% excluding dividends. Below are the top 20 ASX stocks, sorted by their 1-year performance as at 8 July 2016.

The results above (excluding dividends) are extraordinary. We can’t remember a time when Australia’s large cap stocks underperformed the market to such a large degree. Only six of the top 20 stocks beat the index over the past 12 months. The six largest stocks (4 big banks, Telstra and BHP) averaged minus 19.7% (excluding dividends). In contrast, investors exposed to small-mid cap growth stocks have done much better over the past year.

We often get asked whether this trend might continue. It’s a difficult one to answer because every stock has its own characteristics, but we feel the following points are very relevant to the discussion:

- Falling interest rates, which supported a lot of the large-cap names until April last year, are no longer declining as fast, and may not decline any further at all. Thus, the yield chase and the days of stocks rising just because interest rates have fallen are probably well over. We pretty well picked the top of this trend when we wrote about it last year here.

- The tailwind from a falling Australian dollar for offshore earners like QBE, Brambles, Westfield and CSL is largely over, in our view.

- Resource stock prices hit bottom early this year and have been in recovery mode since. But they fell so far, for so long, that their impact on the index is now much less than it was at their peak in 2008. We continue to see a lot of opportunity in the resources market, but you have to be selective. We’re getting most of our exposure through investing with two managers who have proven they can outperform the market. The two big miners do not look like particularly attractive investments.

- Many or our 20 largest companies are living in challenging times, which means they are struggling to grow earnings. Woolworths and Wesfarmers are facing healthy competition in the retail space. The banks, AMP and Macquarie will struggle with wealth management as the rise of Fintech alternatives, boutique advisors/managers and passive investing stifles growth opportunities. Banks also face increasing capital requirements over time, although a lot of this is already priced in.

- Property and infrastructure prices have been one of few positive contributors over the past 12 months. AREITs such as Westfield and Scentre group have performed very well as a result. But growth in asset values from here is not likely to be significant. In addition, rental yields from commercial property and infrastructure are currently very low.

We believe medium-term returns for most ASX20 stocks are likely to be muted, with limited earnings growth and limited further help from falling interest rates or a falling AUD. Perhaps only CSL can deliver well above average earnings growth, and the price at around 25 times 2017 forecast earnings, already reflects that potential.

The opportunity in large cap stocks may not be so much in “buy and hold” strategies, but in buying individual stocks once all the bad news is priced in. In this regard, if we had to pick 5 of the top 20 to invest in right now, we’d nominate ANZ, NAB, WOW, MQG and WPL. These are 5 of the 6 worst performers over the past year – essentially a bet on Australias version of the “dogs of the dow” theory. But we have no confidence in larger stocks generally and we have very little exposure to them in our portfolio.

You’ll notice that our top 5 list above contains three banks. While our banks will not be able to deliver the type of earnings growth or ROE they have been used to in the past, this is already reflected in their share prices. But they’re also great businesses and have a lot of pricing power and that means they just might throw up some interesting trading opportunities. We think now might be a good time to get some exposure to the major banks if you’re one of the very few people in Australia who don’t already own them.

Mythbusting

One of the methods we use to help identify contrarian investment opportunities is to seek out ideas that everyone “knows for sure are true”. In our experience, if almost everyone is betting one way, it pays to look the other. Here’s six things everybody knows are true – and our own view.

Future returns will be lower than in the past.

We think this is just plain wrong. Mostly because past returns haven’t been all that great. We wrote about this problem here. To summarise, average returns from balanced super funds over the past 15 years have been around 6% before tax. If super funds don’t think they can do any better than that over the next 15 years, they should give you your money back and let someone else have a go.

In our view, returns of inflation + 5% over the long term remain achievable, but it requires a different approach. Find those fund managers who’ve proven they can outperform, and who invest in a way that gives them an advantage. They’re not usually managing billions of dollars for a well-known institution, but they are out there is you know where to look. In addition, debt is exceedingly cheap. Quality companies who are prepared to borrow to invest, yet still maintain a strong balance sheet, can do very well in this environment if they can achieve moderate earnings growth.

Market volatility will be higher in the future.

We see this statement made several times a week. In truth, we’ve been guilty of saying it ourselves. But it makes no sense, because the statement is usually made with no historical reference point. Higher than when exactly?

In any event, most commentators are missing the point. Volatility creates opportunity. We welcome it. We do our best work in times of high volatility, when investments we have been monitoring patiently finally become cheap enough for us to buy them. Make no mistake, volatility is the value investors friend. The highest volatility periods are usually the best times to invest.

Interest rates will be lower for longer.

While this is probably true, again, it misses the point. Nothing impacts long term investing returns quite as much as changes in interest rates. If you simply assume one outcome and base your investment strategy on that, the consequences on your portfolio returns of getting it wrong could be substantial.

So, while we may believe interest rates will be lower for longer, we regularly think about what events might cause interest rates to rise unexpectedly, and how our portfolio may be impacted if those events occur. This makes us much more prepared than most, should the unexpected happen.

The Australian dollar will fall further.

Almost everyone’s expecting the AUD to fall a lot further. While predicting currencies is a lottery at the best of times, we doubt it will fall much. Changes in currency over time are mostly about changes in interest rates. Changes in interest rates are mostly about underlying economic performance relative to other countries.

Australians seem to have lost our innate optimism and struggle to get excited about our economic prospects. In our opinion we have become too focused on the negatives. We would do well to remember we’re exporting more than we were previously, we’re still growing much faster than most other developed nations and we’ve just come through the worst resources bust in a generation largely unscathed. Also, our stock market is better value than most others in the world, our demographic profile is sound and foreigners want to live and do business here.

There’s a very real prospect that Australia will in future be viewed more and more as a “safe-haven”. That will be good for our currency and our economy. Further falls in the Australian dollar are by no means a one-way bet. It’s one of the reasons we have had limited exposure to offshore markets for the past 6 months.

Brexit is bad.

We’ll keep this short, because way too much has been written already about this. In our view, Brexit provides Britain with the option to leave or stay, nothing more. Don’t forget, the vote was narrowly won (52% to 48%), and was only advisory in nature. That is, it doesn’t compel the British Government to leave the EU. It’s not a definitive decision and it will take many years for this to all play out.

The EU must (and will) drive a very hard bargain to avoid losing any more EU members. If Britain starts feeling the effects of an exit before deals are agreed, they just might decide to stay. In any event, the real losers, should the Brexit happen, will be Italy, France and Spain. These larger EU countries with more debt, less stable economies and major spending problems will miss the bail-out potential the UK represents.

We view Brexit as a long-term investing opportunity, with bouts of extreme positive and negative sentiment along the way providing us with opportunities to buy/sell exposure to Europe.

The Australian Election result is bad for the economy

So we have a Government with a slim majority, and a problem passing anything through the Senate without support of one or more minor parties. Presumably that will require a compromise somewhere. Big business is moaning that no major reform can happen in these circumstances, and they’re right. But that’s no big deal. The people of Australia, in voting the way they have, are saying they don’t want major reform. While that’s unfortunate, we’ll just have to live with it.

So if you’re a politician wondering what to do – we suggest you forget the game-changing ideas and focus on the small stuff. Seek out those small wins and common-sense changes which boost productivity, reduce inefficiencies or both. Ideas that are more likely to have consensus support because they’re so obviously right that most of Australia thinks they make sense. Find then, fix them and let us know.

Don’t lose sight of the big ideas – but save them for a time when you’ve got runs on the board, and when the electorate sees the need for change – most likely not until we see some real economic pain.

There is one big idea that makes sense – borrow heavily to fund infrastructure spending. If the rest of the world wants to lend Australia money at under 2% for 10 years, let’s work hard to identify projects that are worthy of increasing our debt load for. Ones that will be contributing to economic prosperity in a generation or more. This doesn’t include projects like the NBN – which will likely be technologically obsolete before its finished. Such dynamic infrastructure needs are much better left to private enterprise to develop.

What we’re investing in

Our Affluence Fund portfolio holdings reflect our view of where the best returns are likely to be generated over the next 3-5 years. Through our investments with quality managers in over 20 LICs trading at discounts to their historic values and 20 managed funds, we have an interest in:

- Small-medium ASX-listed companies with above-average growth prospects;

- Deep value plays, with managers who also hold reasonable amounts of cash;

- Resources, with a focus on small-medium producers and Gold mining stocks;

- Long-leased quality property assets with good tenants and very low (or no) debt;

- Selected offshore investments which can deliver returns above what we can get at home; and

- Long/short and market neutral funds to make us money when corrections happen.

We have minimal exposure to ASX20 stocks. We hold no Government bonds, but have a small exposure to an eclectic mix of corporate and hybrid securities. We hold around 15% in cash to top up our investments if we get the opportunity.

We are relatively free to invest the Affluence Fund portfolio anywhere we like. So why is 90% of our money in Australia right now? Well, we usually only go offshore to get access to investment opportunities we can’t get here, or where assets overseas are relatively more attractively priced than in Australia. And where the expected return is significantly higher than the returns we can get in Australia. That second part is important, because by investing offshore we are missing out on franking credits we could likely obtain at home and also taking on a range of additional risks such as exchange rate risk, market risk and legislative risk. We feel there are limited offshore opportunities available right now which adequately compensate us for the additional risk.

We are now more than seven years past the last major market low in March 2009. That puts us quite late in the investment cycle, and requires a degree of caution in portfolio construction. We believe the best defense in this environment is to do exactly as we have done in the Affluence Fund for the past 12 months:

- Don’t buy anything unless you believe (with a high level of confidence) it will deliver reasonable returns, over a reasonable period;

- Diversify by holding investments across all asset classes. Aim to own a portfolio of assets that will respond differently in various market conditions;

- Invest with managers you understand and trust, and who have proven themselves over long periods of time;

- Hold a portion of your portfolio in assets that can hold their value, or even deliver positive returns, when stock markets fall;

- Be very, very, very wary of taking on significant debt, and of any investment that uses substantial leverage to enhance returns; and finally

- Hold some cash to add more quality investments if markets fall a little, or a lot. Your best opportunity to outperform long term averages is by being a buyer when everyone else is a seller.

So far in 2016, we’ve had a number of our very successful managers stop accepting any new investment funds. This generally happens after a long period of good performance, as they get discovered by mainstream investors and advisors and their capacity fills up. While that’s a shame – as it limits how much more we can place with them – we salute them all for recognising that great results can only be delivered with a limited pool of capital.

For our part, we continue to identify a steady stream of great new funds and managers. Those we like now that we believe will be much more popular in 3-5 years. Tomorrows investment heroes. We continue to invest with 1-2 of them each quarter as opportunity allows. Each is demonstrably different to anything else in our Affluence Investment Fund portfolio and thus assists us in our ongoing search for diversification.

If you’d like to join us, think about making a small investment into the Affluence Fund. Our minimum investment amount is just $20,000.

We wish you good luck out there!

Want more of our insights and investment ideas? Go here to register for our monthly newsletter and gain access to our premium content for Affluence Members only. Take charge of your financial future