MA Financial Group – Key Details

Profile date: September 2024

Manager: MA Financial Group

Fund: MA Secured Loan Series

Fund Type: Wholesale Unlisted Fund

Asset Class: Commercial Real Estate Debt.

Investment Strategy: The Fund lends to highly qualified borrowers and real estate transactions for the purpose of real estate investment and development.

Affluence Holdings: The MA Secured Loan Series is a significant investment in the Affluence Income Trust with a position size of approximately 5% at the time of this profile review.

What does MA Financial Group do?

MA Financial Group commenced in Australia in 2009 as a corporate advisory business, in partnership with New York Stock Exchange-listed global investment bank Moelis & Company. They have grown from a corporate advice business into a diversified ASX-listed financial services group. Today they specialise in alternative asset management, lending and corporate advice, and are responsible for over $100 billion in assets across multiple asset classes.

What is the MA Secured Loan Series

The MA Secured Loans Series is a commercial real estate (CRE) debt fund. The Fund commenced in April 2018 and is available only to wholesale investors.

The Manager employs strict investment and risk criteria in loan selection. Risk limits include:

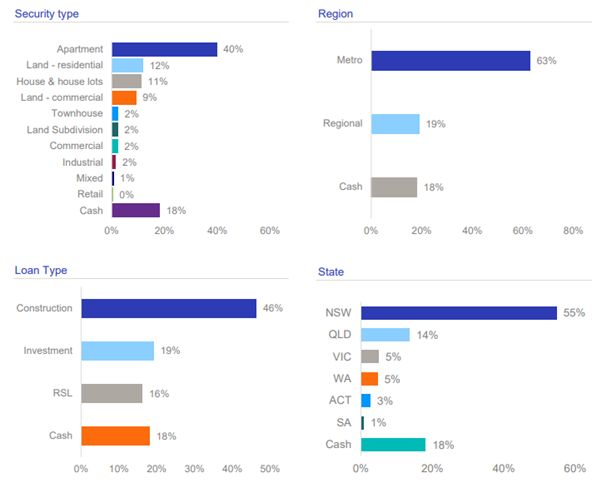

- Diversification – exposure to a mix of residential and commercial properties in metro or areas considered to have sufficient liquidity for an orderly sale of the property if required. No single loan or counterparty representing more than 20% of the portfolio, and median loan size not exceeding 5% of the portfolio.

- Short loan duration – loans are intended for a maximum committed period of 24 months, with the target portfolio having a weighted average duration not exceeding 12 months.

- Strong credit position – all loans are secured by a registered first mortgage over Australian property. All loans are secured on commercial (non-consumer) terms.

Today, the Fund has over $1.5 billion of assets. The following graphs summarise the portfolio of the Fund:

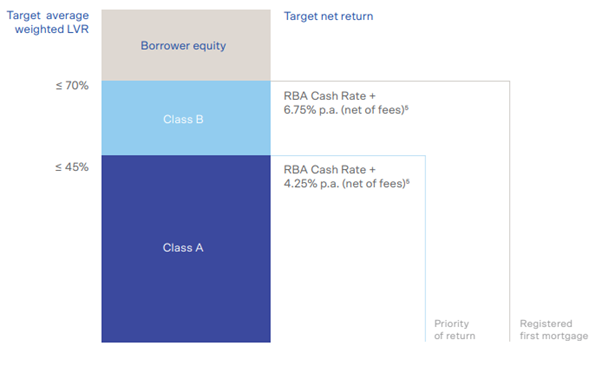

The Fund provides investors with a choice of return/risk profiles by way of two separate classes of units. MA Financial manages both Class A and Class B units. Class A units effectively rank first in each mortgage, with the Class B units ranking behind Class A. Class B unitholders benefit from having the same manager as Class A, unlike other typical debt products which manage second registered mortgages, where a different manager would be involved.

The position and target return for each of the Class A and Class B unitholders is reflected below.

We have currently invested exclusively in the Class A units. The current loan to value ratio (LVR) for Class A is 41%. This provides a huge buffer of equity and Class B debt in each mortgage, before any losses impact Class A unitholders.

MA Secured Loan Series Performance

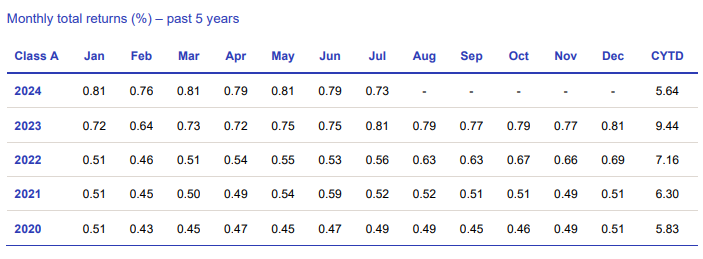

The return split between Class A and Class B has changed a few times since inception, however the performance has been very strong. The following are the monthly returns for Class A units over the past 5 years.

Why we like the Fund

Done properly, we are very comfortable with commercial real estate lending as an investment class. Sensible lending levels against good quality assets and developments, with risks appropriately managed, should provide lenders with attractive returns. MA Financial Group have a long track record in this space, and an experienced team to manage through the cycle.

What we really like is that our exposure is to the A Notes with a target LVR of 45%, and the benefit of B Notes being subordinated on each loan. The A Notes provide a margin of 4.25% above the RBA cash rate, which we believe is a very strong return for a relatively low LVR level. At the current RBA rate the Affluence Income Trust is receiving an all up return of 8.6% per annum against a diversified portfolio and strong credit attributes.

Conclusion

The MA Secured Loan Series has a long track record of strong returns. Given the target return of RBA cash rate plus 4.25%, we believe that on a risk adjusted basis, investing in this Fund is a superior alternative to investing in most types of direct property assets at this point in the cycle.

We hope that was helpful.

Learn more about the Affluence Income Trust.

If you enjoyed this Fund Manager Profile, you can view our August 2024 profile.

Want to learn more about Fixed Income?

You can download our Guide to Fixed Income

Disclaimer

This Fund Profile was prepared by Affluence Funds Management Limited (Affluence). It was prepared to assist investors in various Affluence funds in understanding the investments of the relevant Affluence fund in more detail. It is not an investment recommendation. Prospective investors are not to construe the contents of this article as tax, legal or investment advice. Neither the information nor any opinion expressed constitutes an offer by Affluence, its subsidiaries, associates or any of their respective officers, employees, agents or advisers to buy or sell any financial products nor the provision of any product advice or service.

This Fund Profile does not take into account your objectives, financial situation or needs. In deciding whether to acquire or continue to hold an investment in any financial product, you should consider the relevant disclosure documents for that product which are available from the product provider. Affluence recommends you consult your professional adviser before making any decision to invest.