Key Details

Profile date: December 2025

Manager: MA Financial Group (IP Generation)

Fund: MA Hyperdome Town Centre Fund

Fund Type: Wholesale single asset property syndicate

Investment Strategy: The syndicate will own Hyperdome Town Centre for an initial period of 5-7 years.

Affluence Allocation: The MA Hyperdome Town Centre Fund Affluence Investment Fund has a portfolio allocation of approximately 1.9%.

What is the MA Hyperdome Town Centre Fund?

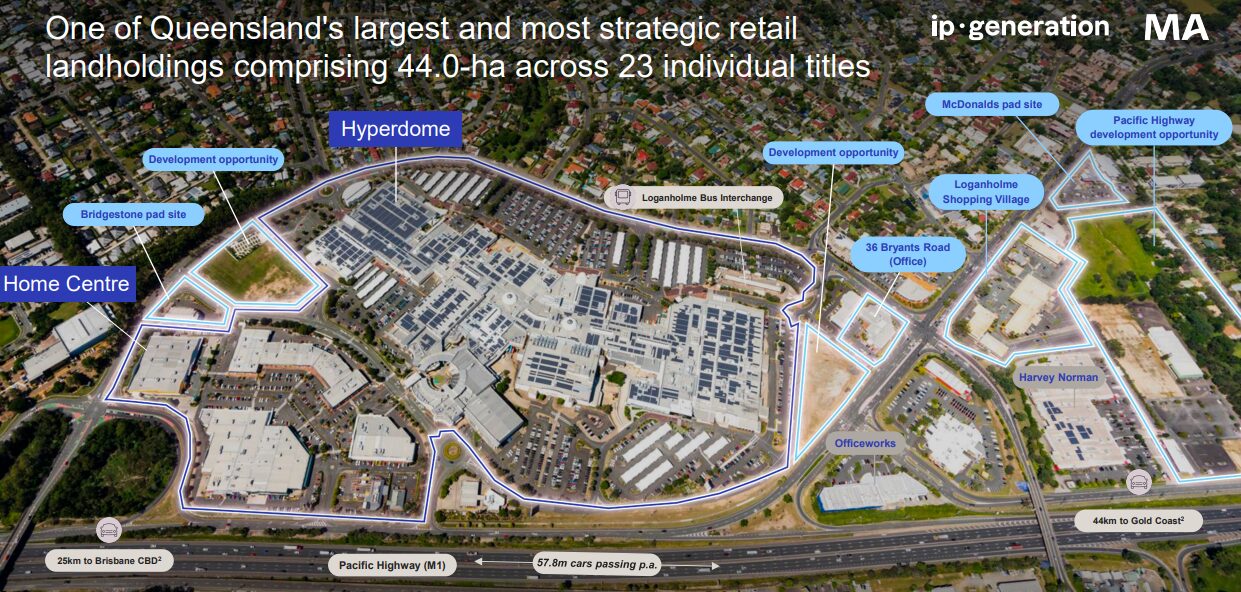

The MA Hyperdome Town Centre Fund is an unlisted property syndicate that owns the Hyperdome Town Centre and surrounding properties located in Logan, just south of Brisbane.

Following the acquisition of IP Generation in September 2025, MA Financial Group is now one of Australia’s largest, fully integrated retail real estate platforms. MA Financial Group is an ASX listed company (ASX: MAF). It began in 2009 as a corporate advisory business in partnership with the New York Stock Exchange listed investment bank Moelis & Company. They have grown from a corporate advice business into a financial services group. They now specialise in alternative asset management, lending and corporate advice.

IP Generation was founded in 2018 and manages over $2 billion of retail shopping centre assets across 10 funds that own 14 shopping centres located in New South Wales, Queensland, Victoria and Western Australia on behalf of high net wealth investors.

Hyperdome Town Centre

The Hyperdome Town Centre is located in the suburb of Shailer Park approximately 25 kilometres south-east of Brisbane.

It incorporates the Hyperdome Shopping Centre and the Hyperdome Home Centre, which the manager considers to be the core investments of the Fund. Also included is a collection of income producing assets comprising two freestanding sites (McDonald’s & Bridgestone), an office building and a shopping village. Additionally, there are four strategic land parcels spread across multiple titles.

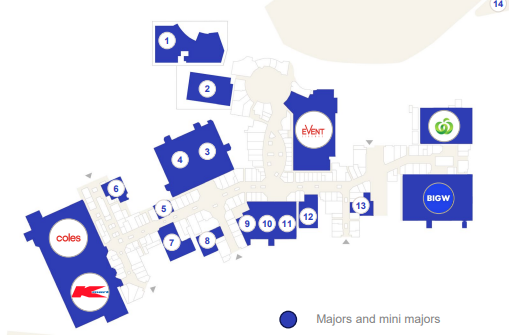

Hyperdome Shopping Centre comprises a fully enclosed, Regional Shopping Centre that provides retail accommodation over primarily a single level and has a total GLA of 73,090 sqm. The Centre is anchored by a Kmart (7,918 sqm) and Big W (6,602 sqm) discount department stores, Woolworths (3,762sqm), Coles (5,340 sqm) and ALDI (1,610 sqm) supermarkets, and an Event Cinemas (6,350 sqm). Majors are supported by 15 mini-majors, 156 specialty stores, 21 kiosks, 2 ATMs, and 3 pad sites.

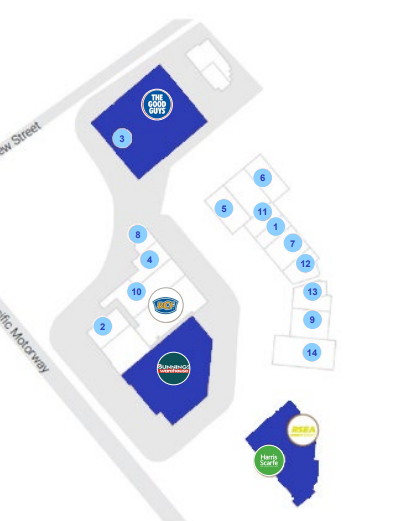

The Home Centre comprises a large format retail centre. The Home Centre accommodation is located across four individual buildings, with external mall alignments across the site generally fronting a central car park. The Home Centre has a diverse tenancy mix with strong national brand representation. With notable tenants including a small format Bunnings and The Good Guys. The Home Centre has a total of 21 tenancies providing a total GLA of 22,487 sqm.

The MA Hyperdome Town Centre Fund has purchased the asset from Queensland Investment Corporation (QIC) for $678.7 million.

The manager plans to hold the Shopping Centre and Home Centre for an initial period of 5 years, and to potentially monetise the peripheral assets gradually as opportunities arise. Depending on the value apportioned to the peripheral assets, the shopping centre and home centre have been acquired on a cap rate (yield) of between 6.5%-7.00%. We believe these are attractive valuation metrics for a centre of this quality. In addition, there is potential for the manager to achieve prices for the peripheral assets well in excess of the allocated purchase price.

The centre has been trading well with strong sales growth over the past few years. Recent capital expenditure on the asset has significantly derisked some of the historical issues with the centre since Myer departed in 2019. These projects include the relocation and expansion of Woolworths to the latest format store, refurbishment of the Big W tenancy, creation of a fresh food precinct, the introduction of Aldi, and the backfill of the Myer space to various tenants including JB Hi-Fi, Rebel and Spotlight.

MA Hyperdome Town Centre Fund

The Hyperdome Town Centre is being purchased with a combination of equity and bank debt. The initial loan to value ratio will be approximately 50% of the purchase price, with a covenant of 60%. We are comfortable with these gearing levels, given the asset quality and attractive purchase price.

The manager is targeting to pay investors quarterly distributions, with an initial distribution yield of 8.0% per annum, growing to 10.0% per annum over the five-year forecast period. They have also given financial information targeting a 16-18% IRR for the investment. We are always wary of long term forecasts, given the significant uncertainty over future assumptions. However, given the attractive price paid for the asset, we believe the forecasts appear reasonable.

The manager has raised over $400 million for the Fund, with purchase of the asset completing in December 2025. The equity raising was open to wholesale and institutional investors only.

Conclusion

We believe this is an excellent investment for the Affluence Investment Fund. It increases overall diversification, provides regular income and provides the potential for strong overall returns if the manager can achieve their asset management strategies and sales targets for the perephial properties.

We hope that was helpful.

Learn more about the Affluence Investment Fund

Want to learn more about Managed Funds?

You can download our Guide to Managed Funds

Enjoyed this Investment Profile?

Read our September 2025 Fund Manager Profile Regal Partners Private Fund – Affluence Funds Management

Disclaimer:

This Fund Profile was prepared by Affluence Funds Management Limited (Affluence). It was prepared to assist investors in various Affluence funds in understanding the investments of the relevant Affluence fund in more detail. It is not an investment recommendation. Prospective investors are not to construe the contents of this article as tax, legal or investment advice. Neither the information nor any opinion expressed constitutes an offer by Affluence, its subsidiaries, associates or any of their respective officers, employees, agents or advisers to buy or sell any financial products nor the provision of any product advice or service.

This Fund Profile does not take into account your objectives, financial situation or needs. In deciding whether to acquire or continue to hold an investment in any financial product, you should consider the relevant disclosure documents for that product which are available from the product provider. Affluence recommends you consult your professional adviser before making any decision to invest.