Pengana Private Equity Trust (ASX:PE1)

Key Details

Profile date: June 2025

Manager: Pengana Capital Group

Fund: Pengana Private Equity Trust (ASX: PE1)

Fund Type: Listed Investment Trust (LIT)

Asset Class: Global private equity.

Investment Strategy: Pengana Private Equity Trust utilises the management services of Grosvenor Capital Management to invest in a diversified portfolio of global private equity investments.

Affluence Holdings: PE1 is currently held by the Affluence LIC Fund, and it comprises approximately 3.5% of the portfolio.

Important note: All figures are as at 31 May 2025 and can change significantly over time.

What does Pengana Private Equity Trust (PE1) do?

PE1 provides access to a globally diversified portfolio of private equity investments. PE1 is managed by Pengana Capital Group, an ASX listed fund manager. The Trust’s investment manager is Grosvenor Capital Management (GCM), one of the largest and most diversified asset managers globally, with extensive experience in private markets. GCM’s expertise and global reach enable PE1 to access high-quality private equity investment opportunities that are typically unavailable to retail investors.

The trust was launched via IPO in April 2019 and has raised additional capital subsequently in 2020 and 2022.

What does is Pengana Private Equity Trust (PE1) invest in?

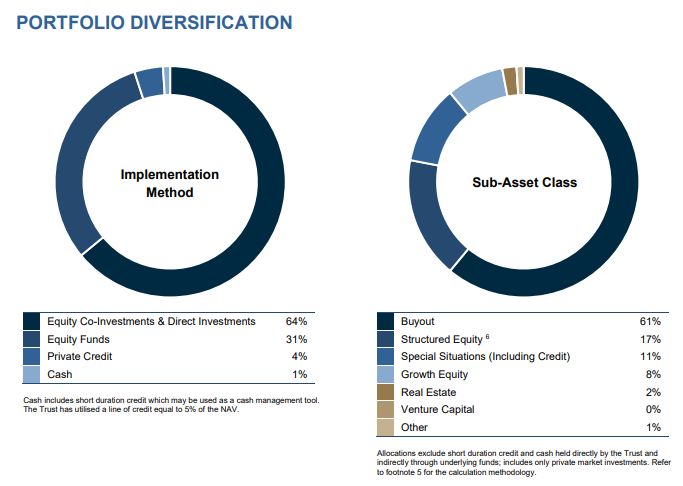

The following graph summarises the PE1 portfolio at 31 May 2025:

The portfolio is a mixture of funds managed by GCM and direct private equity co-investments. GCM has also invested in some private credit situations where they believe there is an appropriate risk reward proposition. The portfolio currently has exposure to over 500 companies, with the top holdings as at 30 April 2025 as follows:

PE1 Performance

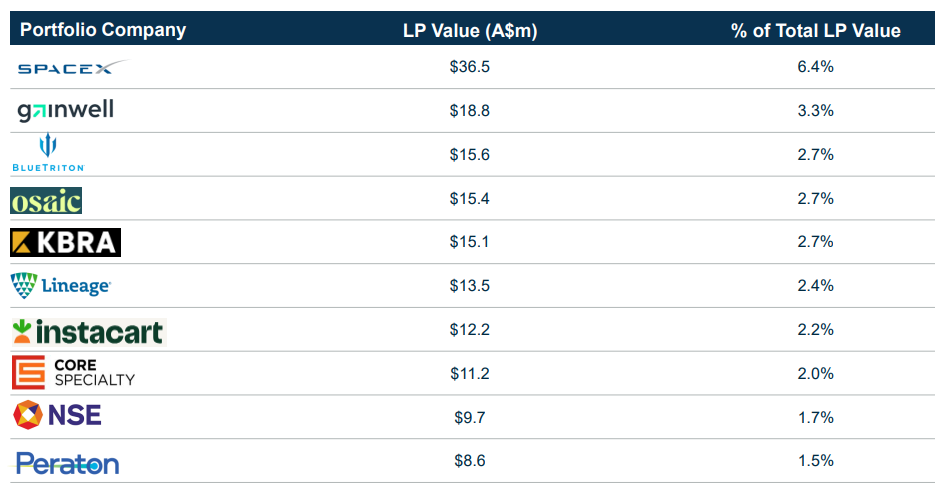

The following table shows the underlying portfolio performance of PE1 since inception. This is based on the change in underlying NAV plus distributions.

The underlying performance has been reasonable, without being outstanding. The majority of investments are US based and therefore returns are also impacted by currency movements.

PE1 Share Price and NAV

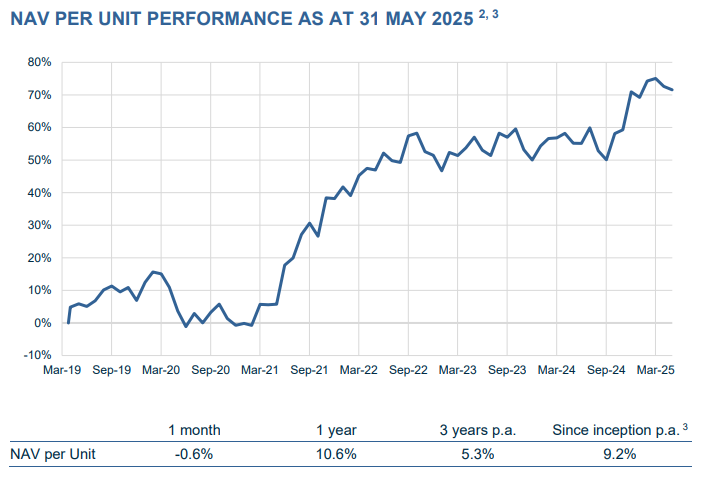

The initial trading performance for PE1 was very strong, with a sustained period of trading above NAV. Even post pandemic, PE1 continued to show resilience compared to the broader LIC/LIT market which continued trading at bigger discounts to NAV.

The discount to NAV started expanding in 2023. This coincided with a period of softer performance in private equity markets and a continuing lacklustre LIC/LIT market.

The graph below shows the discount to NAV since inception in April 2019.

With the discount continuing to increase, and appearing to be ‘stuck’ at more than 30%, the manager announced in March 2025 a new capital management initiative – a flexible on-market buyback.

PE1 Buyback Structure

On an ongoing basis, cash flow will be generated within the Trust from realisation (sale) of underlying investments. These proceeds would normally be available for new investment activity. In future, where units are trading on ASX at a discount to the NAV, a portion of these proceeds that is not otherwise committed or reserved to fund existing investments, or required to cover expenses or other liabilities (“Available Cashflow”), will be allocated to the repurchase of units via an on-market buy-back. The proportion of Available Cashflow to be made available for the on-market buyback will be based on the following general principles:

| Discount to NAV per Unit | Portion of Available Cashflow used for an on-market buy back |

| 0% to 5% | 25% |

| 5% to 10% | 50% |

| 10% or more | 75% |

In order for there to be material “Available Cashflow” for the on-market buy back, there needs to be a reasonable level of realisations within the portfolio. This has been an ongoing issue for the private equity industry, with lower than usual sales rates, and many investors having to wait far longer for the return of their capital then they expected.

The manager expects investment sales to increase towards the end of this year and into next year. If this occurs, we see this as a catalyst for a more aggressive on-market buy back. This could materially improve the discount to NAV.

Why we like PE1

PE1 is managed by a top class private equity investor in Grosvenor Capital Management, and is exceptionally well diversified by GP manager, vintage and industry. Historically it used to be difficult for retail investors to be able to access this type of institutional investment.

Most private equity investments have been impacted by lower than normal levels of portfolio sales. This has led to lower portfolio performance and a slower return of cash. There are good reasons to expect deal flow to return to more normal levels in coming years, which should improve cash flows and returns.

Pengana has announced the capital management initiative to reduce the 30% discount to NAV. We are optimistic that this can add value over the next 12-24 months, in addition to the returns from the underlying private equity investments.

We hope that was helpful.

Learn more about the Affluence LIC Fund.

Want to learn more about Fixed Income?

You can download our Guide to Listed Investment Companies

Enjoyed this Investment Profile?

Read our April 2025 profile Pzena Global Focused Value Fund – Affluence Funds Management

Disclaimer

This Fund Profile was prepared by Affluence Funds Management Limited (Affluence). It was prepared to assist investors in Affluence funds in understanding the investments of the relevant Affluence fund in more detail. It is not an investment recommendation. Prospective investors are not to construe the contents of this article as tax, legal or investment advice. Neither the information nor any opinion expressed constitutes an offer by Affluence, its subsidiaries, associates or any of their respective officers, employees, agents or advisers to buy or sell any financial products nor the provision of any product advice or service.

This Fund Profile does not consider your objectives, financial situation or needs. In deciding whether to acquire or continue to hold an investment in any financial product, you should consider the relevant disclosure documents for that product which are available from the product provider. Affluence recommends you consult your professional adviser before making any decision to invest.