Pzena Global Focused Value Fund

Key Details

Profile date: April 2025

Manager: Pzena Investment Management

Fund: Pzena Global Focused Value Fund

Fund Type: Retail Unlisted Fund

Asset Class: Global Equities.

Investment Strategy: The Fund uses a deep value investment strategy to invest in 40-60 global stocks located mainly in developed markets.

Affluence Allocation: The Affluence Investment Fund has a portfolio allocation of approximately 2% to the Pzena Global Focused Value Fund.

Who is Pzena Investment Management?

Pzena Investment Management are a US based global equities manager. The company was founded in 1995 by Rich Pzena who is the architect of the firm’s investment strategy. Today they manage almost US$70 billion of assets across US and global strategies.

What is the Pzena Global Focused Value Fund?

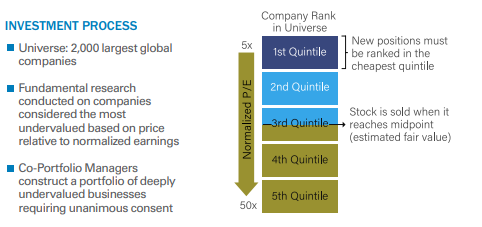

The Pzena Global Focused Value Fund aims to hold 40-60 global stocks selected from an investment universe of the 2,000 largest companies worldwide. All Pzena strategies use a common value orientated process to build their portfolios:

- Focus on the most undervalued segment of the investment universe, as identified using their proprietary screening tool, based on price to normalised earnings.

- Analysts perform an initial review of assigned companies to determine the reasons for the stock price decline and if they believe they are temporary.

- If portfolio managers think it is warranted, analysts perform an in-depth research project on the company, including financial analysis, field work, meeting with management, and speaking with an external analyst who is bearish on the stock.

- Through team discussion and debate, they develop a refined estimate of normalised earnings and determine if the company should be included in their portfolios.

What makes their process unique is that they can only purchase the stock if it is in the cheapest quintile of the market.

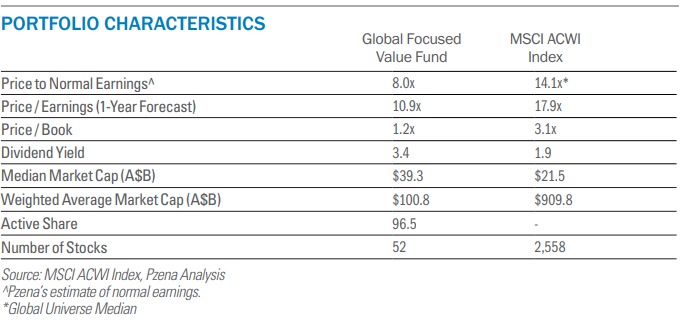

The resulting portfolio is demonstrably cheaper than the market, and shows very attractive overall valuation metrics (data as at 31 March 2025):

Pzena Global Focused Value Fund Performance

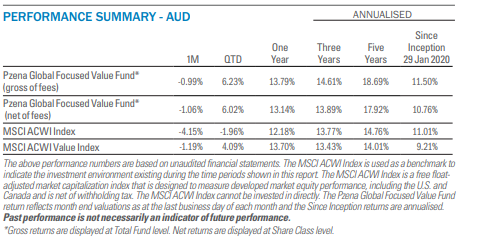

The following table shows the returns for the Fund as at 31 March 2025:

Given the concentration in global markets and an anvironment much friendlier to growth stocks, we believe the performance of the Fund is very impressive. By definition, the Pzena process is contrarian in nature and usually buying stocks that have fallen out of favour.

Why we like the Pzena Global Focused Value Fund

At Affluence we are contrarian and value focused, and therefore it is not surprising that the Pzena investment process resonates with us.

Their process is very transparent, well defined and repeatable. The portfolio managers for the Fund are vastly experienced, and have all been with Pzena for 20+ years.

Conclusion

We expect the Pzena Global Focused Value Fund to produce net returns in excess of its benchmark over time. This investment strategy is differentiated, and has been proven to work over a long period.

We often prefer smaller boutique managers, however, given the asset class and their contrarian nature we believe Pzena are an exceptional manager.

We hope that was helpful.

Learn more about the Affluence Investment Fund.

Want to learn more about Fixed Income?

You can download our Guide to Managed Funds

Enjoyed this Investment Profile?

Read our March 2025 profile WAM Alternative Assets – Affluence Funds Management

Disclaimer

This Fund Profile was prepared by Affluence Funds Management Limited (Affluence). It was prepared to assist investors in various Affluence funds in understanding the investments of the relevant Affluence fund in more detail. It is not an investment recommendation. Prospective investors are not to construe the contents of this article as tax, legal or investment advice. Neither the information nor any opinion expressed constitutes an offer by Affluence, its subsidiaries, associates or any of their respective officers, employees, agents or advisers to buy or sell any financial products nor the provision of any product advice or service.

This Fund Profile does not take into account your objectives, financial situation or needs. In deciding whether to acquire or continue to hold an investment in any financial product, you should consider the relevant disclosure documents for that product which are available from the product provider. Affluence recommends you consult your professional adviser before making any decision to invest.