Key Details

Profile date: September 2025

Manager: Regal Funds Management

Fund: Regal Partners Private Fund

Fund Type: Wholesale Unlisted Fund

Asset Class: Multi-asset, multi-strategy.

Investment Strategy: The Regal Partners Private Fund aims to generate attractive risk adjusted absolute returns by investing in a range of Regal’s highest performing alternative investment strategies. Capital is allocated across long / short equities, private credit, resources royalties, unlisted and pre-IPO investments, and other uncorrelated asset classes

Affluence Holdings: The Affluence Investment Fund has a portfolio allocation of approximately 1.5% to the Regal Partners Private Fund.

Who is Regal Funds Management?

Regal Funds Management is a specialist alternatives investment manager. Since it was founded in 2004, Regal have been a pioneer of the local hedge fund, private markets and alternatives industry in Australia.

Regal was originally formed by Phil and Andrew King and focused on long/short equities. In recent years, the Regal funds management business was listed and has expanded its strategies to include:

- Private markets.

- Real & natural assets (with Kilter Rural, Attunga Capital and Argyle Group).

- Credit and resource royalties (with Merricks Capital and Taurus Funds Management).

- Additional long/short equities strategies (with VGI and PM Capital).

Today Regal is an ASX listed company, with total funds under management of approximately $17.7 billion. They manage investments on behalf of institutions, family offices, charitable groups and private investors.

What is the Regal Partners Private Fund?

The Regal Partners Private Fund aims to generate attractive risk adjusted absolute returns by investing in a range of Regal’s highest performing alternative investment strategies. It is intended that the investment strategies will be highly diversified, with capital allocated across long / short equities, private credit, resources royalties, unlisted and pre-IPO investments, and other uncorrelated asset classes. The Fund will tactically allocate capital between strategies, with an aim to deliver consistent positive returns with lower volatility and limited correlation to traditional asset classes.

It is a fund of funds and draws from Regal and its associated managers to produce a unique portfolio.

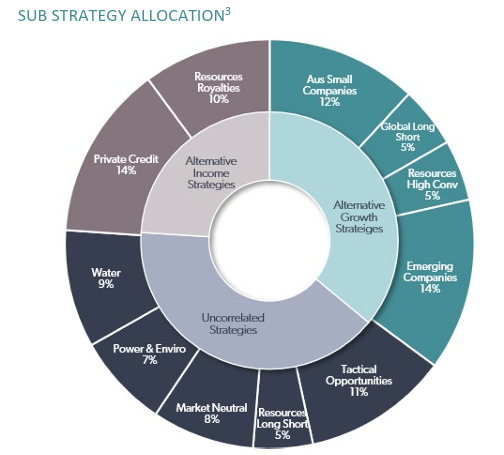

The following graph shows the asset allocation as at 31 July 2025:

A number of strategies the Fund invests in are either soft or hard closed, meaning that investing in the Fund is the only option to gain access to these strategies.

The manager does not charge multiple layers of fees. There are fees charged at the Fund level, however all underlying strategy fees are rebated.

Regal also has an ASX listed vehicle, Regal Investment Fund (ASX: RF1), which runs a similar strategy.

Regal Partners Private Fund Performance

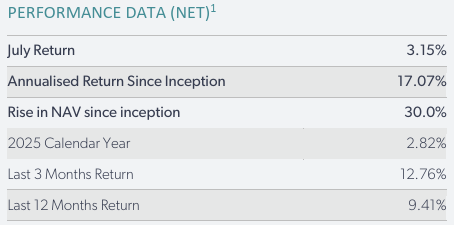

The following table shows the returns for the Fund as at 31 July 2025:

Performance Data

Investment Performance

Performance has been strong and reasonably consistent with the exception of March 2025. During that month, a number of underlying strategies had a high conviction exposure to an ASX listed biopharmaceutical company called Opthea. As a result of the failure of clinical trials, the company was written down to zero, resulting in a loss for the Fund of -8.3%. Following this event, Regal implemented several changes to its risk management processes, which we believe significantly reduce the risk of a similar incident occurring again.

Why we like the Regal Partners Private Fund

Regal is one of the premier alternative asset managers in Australia. They have a long history of strong returns from niche investment strategies. The Regal Partners Private Fund provides diversified access to some of their best performing funds (and in some cases the only way for new investors to access these strategies). The Fund also accesses the asset allocation skills of the Regal investment committee, which seeks to tactically tilt the asset allocation to enhance risk adjusted returns.

Conclusion

Generating strong differentiated returns is a very valuable component of the Affluence Investment Fund, and we expect to increase the size of our investment in the Regal Partners Private Fund over time.

We hope that was helpful.

Learn more about the Affluence Investment Fund

Want to learn more about Managed Funds?

You can download our Guide to Managed Funds

Enjoyed this Investment Profile?

Read our June 2025 Fund Manager Profile Pengana Private Equity Trust – Affluence Funds Management

Disclaimer

This Fund Profile was prepared by Affluence Funds Management Limited (Affluence). It was prepared to assist investors in various Affluence funds in understanding the investments of the relevant Affluence fund in more detail. It is not an investment recommendation. Prospective investors are not to construe the contents of this article as tax, legal or investment advice. Neither the information nor any opinion expressed constitutes an offer by Affluence, its subsidiaries, associates or any of their respective officers, employees, agents or advisers to buy or sell any financial products nor the provision of any product advice or service.

This Fund Profile does not take into account your objectives, financial situation or needs. In deciding whether to acquire or continue to hold an investment in any financial product, you should consider the relevant disclosure documents for that product which are available from the product provider. Affluence recommends you consult your professional adviser before making any decision to invest.