Key Details

Profile date: October 2025

Manager: Terra Capital

Fund: Terra Capital Natural Resources Fund

Fund Type: Wholesale Unlisted Fund

Investment Strategy: The Fund invests in a portfolio of mostly small and mid-cap (less than $500 million) mining and energy equities and is index and industry agnostic.

Affluence Allocation: The Affluence Investment Fund has a portfolio allocation of approximately 3.5% to the Terra Capital Natural Resources Fund.

Who is Terra Capital

Terra Capital is a Sydney based fund manager, owned by management. They run two funds, this one and a green metals specialist fund. Terra was founded by Jeremy Bond, and Matt Langsford joined the firm in 2013. The portfolio managers hold significant personal stakes in their funds, helping ensure that their interests are aligned with those of fund investors.

What is the Terra Capital Natural Resources Fund?

The Terra Capital Natural Resources Fund commenced in June 2010, and has invested across a wide range of varying commodity cycles. The Affluence Investment Fund first invested in this fund in 2016 and has held the investment since then, though the position size has varied over time.

The Terra Capital strategy is based on deep fundamental analysis and understanding market sentiment. They combine top-down analysis (macro/commodity trends) with extensive bottom-up stock research (company fundamentals, management quality, asset risk). Most of the portfolio will be in 10-20 investments. The manager targets companies in the lowest quartile of the cost curve that are simple to understand and have little of no debt. They look to buy well below Terra Capital’s estimate of the underlying value. They aim to hold 15% cash on average, but this can fluctuate significantly as markets and opportunities wax and wane.

The key investment objective for the Terra Capital Natural Resources Fund is to generate returns of more than 10% per annum over 5-7 year periods. Their advantage is being a specialist investor in a market that has few professional investors as competition.

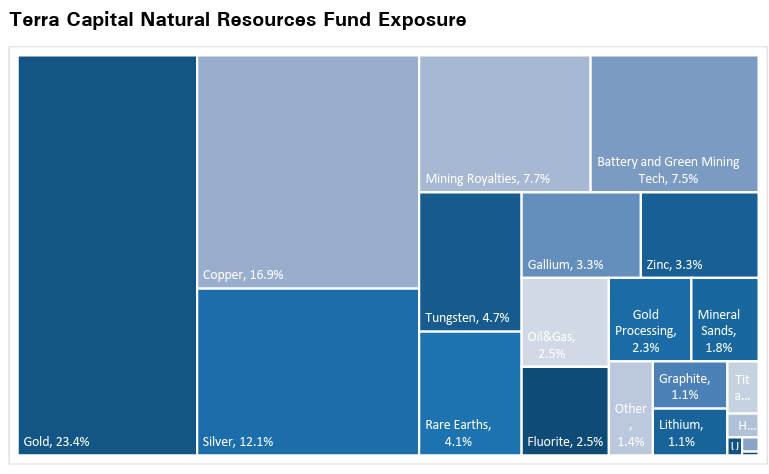

The fund provides exposure to a wide range of commodities. For quite a few years, the fund’s largest exposures have been to precious metals (gold and silver equities) and copper equities. The following graphic shows the fund exposure by commodity at 30 September 2025:

Terra Capital Natural Resources Fund Performance

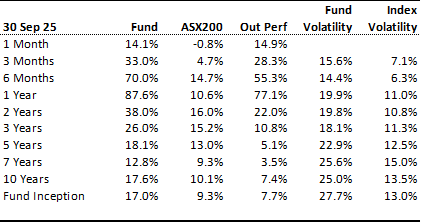

The following table shows the returns for the Fund as at 30 September 2025:

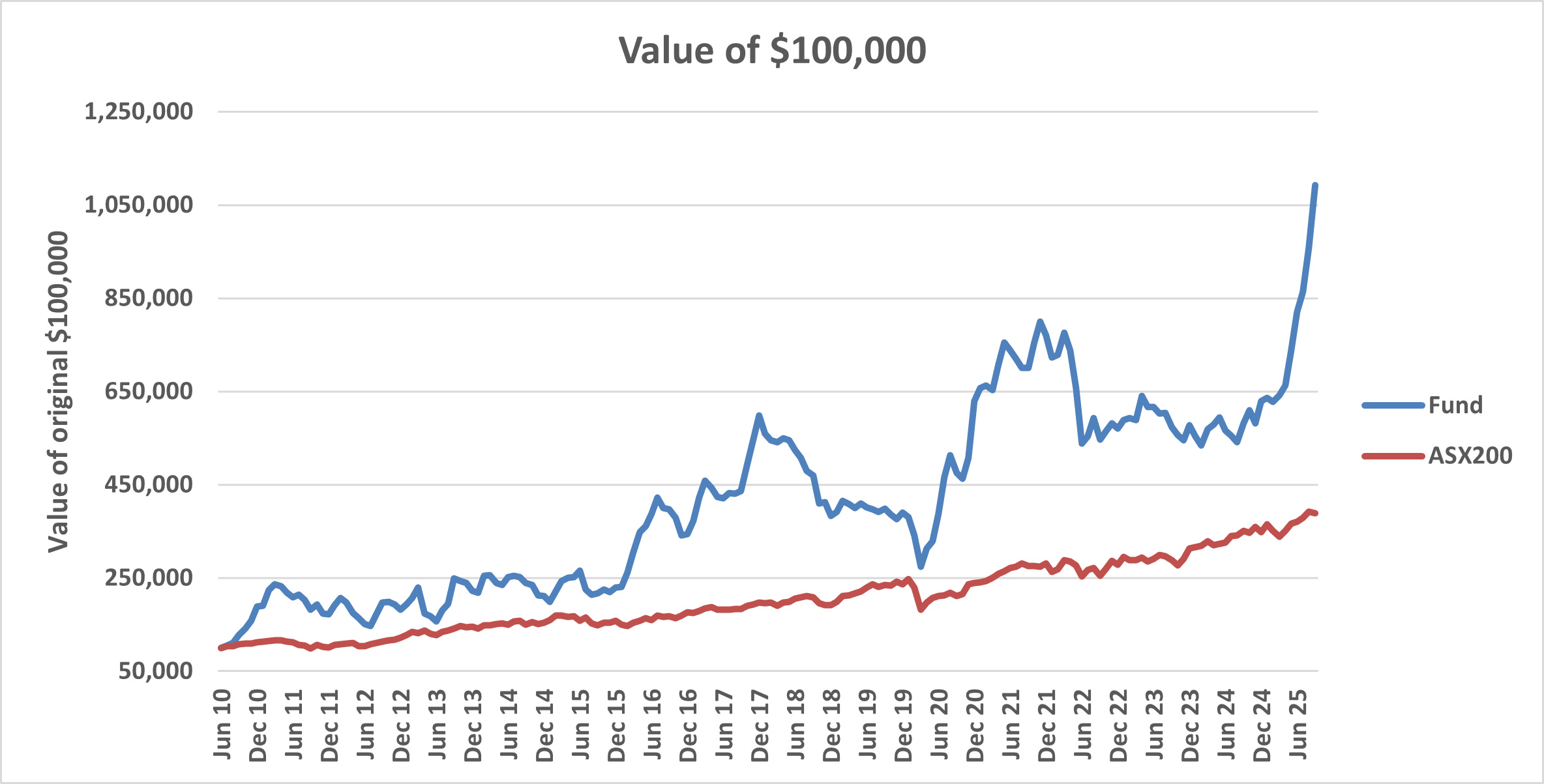

Recent performance has been exceptional, which has the effect of also improving the longer-term numbers. The price to pay for such high performance in a niche asset class is high variability of returns (volatility). Volatility has been 28% for the Fund since inception. For comparison, the ASX 200 volatility for the same period has been 13%. This is clearly shown by the graph above.

The fund has experienced a range of 3 month returns from negative 31.3% to positive 58.3%. We have taken this volatility into account by making a smaller allocation to this Fund than we might do if it were less volatile.

The Terra Capital Natural Resources Fund is only open to wholesale and sophisticated investors, and has a minimum investment amount of $50,000.

Why we like the Terra Capital Natural Resources Fund

One of our core values when selecting funds is trying to find managers who invest in niche asset classes with less professional competition. Small and mid-cap mining and energy equities certainly fit these criteria. This is one of very few funds that invest solely in these assets. This is a significant advantage, as specialised knowledge and industry contacts are required to do it well. Terra Capital have delivered, with the fund performing strongly since its inception in 2010. There have been difficult times for investors, but patience and trust have resulted in strong returns.

Conclusion

We believe that the Terra Capital Natural Resources fund is an exciting investment that has demonstrated exceptional historical performance. The manager has the skills to outperform in a niche area and find outstanding investments with a very differentiated strategy. However, given the volatility and potential substantial drawdowns, the Affluence Investment Fund holds a relatively small position. The Fund provides an excellent source of potential outperformance.

We hope that was helpful.

Learn more about the Affluence Investment Fund

Want to learn more about Managed Funds?

You can download our Guide to Managed Funds

Enjoyed this Investment Profile?

Read our September 2025 Fund Manager Profile Regal Partners Private Fund – Affluence Funds Management

Disclaimer:

This Fund Profile was prepared by Affluence Funds Management Limited (Affluence). It was prepared to assist investors in various Affluence funds in understanding the investments of the relevant Affluence fund in more detail. It is not an investment recommendation. Prospective investors are not to construe the contents of this article as tax, legal or investment advice. Neither the information nor any opinion expressed constitutes an offer by Affluence, its subsidiaries, associates or any of their respective officers, employees, agents or advisers to buy or sell any financial products nor the provision of any product advice or service.

This Fund Profile does not take into account your objectives, financial situation or needs. In deciding whether to acquire or continue to hold an investment in any financial product, you should consider the relevant disclosure documents for that product which are available from the product provider. Affluence recommends you consult your professional adviser before making any decision to invest.