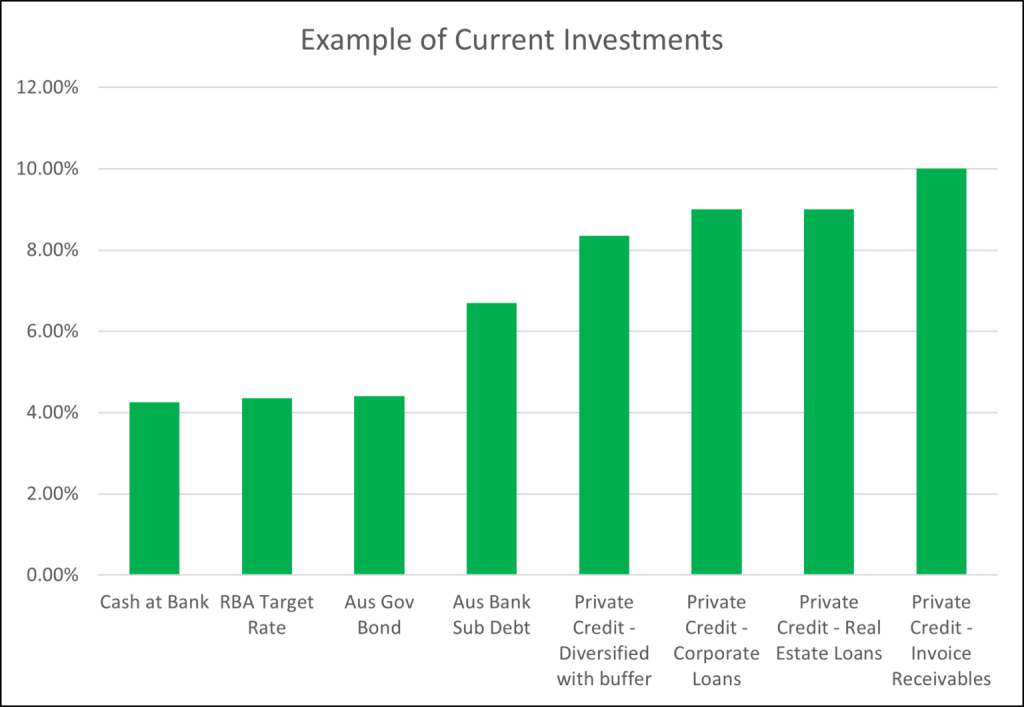

Fixed Income is back in vogue. For many years until the end of 2021, we saw extremely low (and even negative) interest rates. But since early 2022, central banks around the world have dramatically increased rates as part of the fight against inflation. While this has had a negative impact on many asset classes, it has had the very positive outcome of making the entire fixed income sector much more attractive. Investors can now achieve returns above 4% per annum from cash in the bank and term deposits. Returns from private credit range from about 6% to 10% per annum, and yields on many higher risk fixed income assets can be even higher.

While still not high by historical standards, the current 4.35% RBA cash rate is the tide that has lifted all boats. The majority of fixed income investments are referenced to the central bank rate plus a premium for risk. Therefore the 4.25% increase in the cash rate since 2022 from 0.10% has increased the available returns by a similar margin.

Investors can now put together a very attractive portfolio of diversified fixed income assets that can offer returns very close to long term equity market averages, with much lower risk and volatility.

Within the Affluence Investment Fund, we have increased the fixed income allocation from 3% in April 2022 to 12% currently, and we continue to increase this further. We are currently generating returns of more than 7.5% per annum on this allocation, with significantly less risk that most other asset classes.

What is Fixed Income?

Fixed income refers to investing in debt or loans. A loan is an advance of money to a borrower with prescribed obligations to make interest payments on the amount borrowed, and an obligation to repay the loan in full after the expiry of the loan. As the interest returns generated from fixed income and the repayment of the loan amount are contractually obligated, fixed income investments usually offer much lower volatility and risk than equity investments.

Fixed income investments range from term deposits to government bonds, private loans and high yield bonds. Use of the funds range from personal loans for individuals to financing governments and everything in between.

The four main elements of Fixed Income include:

- Loan amount – The amount which has been lent to the borrower.

- Loan term – When is the borrower required to repay the loan.

- Interest rate – The compensation paid to the lender by the borrower for borrowers use of the funds.

- Loan covenants – The terms and conditions that the borrower has stipulated the loan was made on.

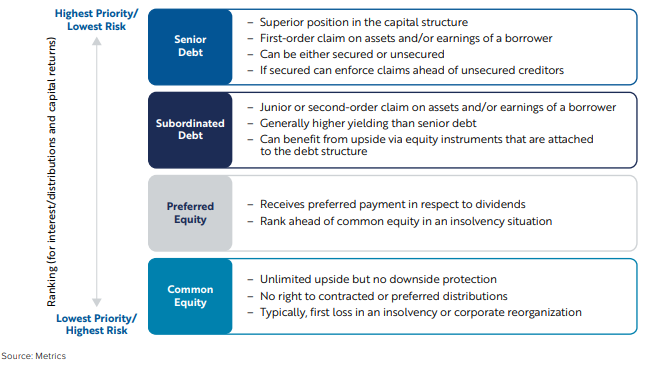

One of the key elements that reduces the risk of fixed interest investments compared to equity investments is the priority in the ranking of the capital structure. Debt providers generally have preferential treatment over equity holders for income distributions and capital returns in the event of insolvency. As the debt holders are eligible to be repaid first, senior debt is generally regarded as the lowest risk tranche in the capital stack. Equity, which is repaid last, has the highest risk. Other types of instruments, such as subordinated debt and preferred equity, can rank between senior debt and equity.

Why invest in Fixed Income?

Many investors from individuals through to the largest pension and superannuation funds have significant allocations to Fixed Income in their portfolios. Some key benefits of investing in Fixed Income include:

- Capital stability – While the value of an equity investment or property can vary, the value of the debt (or loan) is contractually obligated to be repaid. Therefore, excluding a loan default an investor knows the value of the investment.

- Regular Income – Unlike equity investments where dividends/distributions are dependent on profits, fixed income has contractual obligations expressing when interest payments must be paid, ensuring a much more reliable income stream.

- Priority in the capital structure – In the event of a default, a lender ranks ahead of equity investors in the capital structure and will therefore receive the proceeds of any recovery of funds before equity investors. Fixed income by its very nature is a lower risk alternative compared to an investment in equities.

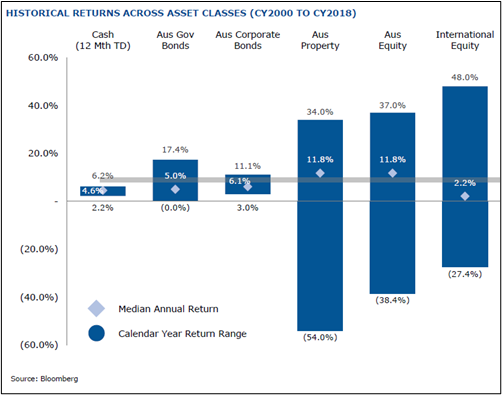

- Lower volatility – The majority of Fixed Income asset classes have significantly lower volatility of returns compared to equity investments.

- Uncorrelated returns – Investing in Fixed Income may provide uncorrelated returns compared to other major asset classes. This can be very beneficial if the fixed income allocation of a portfolio can provide positive returns when other asset classes provide negative returns.

- Lower risk and drawdowns – In times of market stress when equity and property markets fall in value, it is likely that fixed income investments will fall a by much smaller amount, if at all, and may even increase in value.

The below graph demonstrates the reduced volatility of fixed income assets compared to equities.

Current Opportunities in Fixed Income

We have undertaken extensive research over the past 9 months on the Fixed Income sector, identifying the sub-sectors and managers that we believe offer the best risk adjusted returns. We have been impressed with the range and depth of managers available, many pursuing differentiated and successful strategies. We have put together a portfolio within the Affluence Investment Fund that is delivering equity like returns with much lower risk.

The following graph shows an example of some of the Fixed Income investments we hold within the Affluence Investment Fund, and their current annualised returns, alongside the current RBA cash rate.

Like any investment, Fixed Income investments are not without risk. The private credit fund that is returning 10% obviously carries more risk than cash in the bank returning 4.25%. The skill in choosing Fixed Income managers is to back those investment teams that have shown strong risk management skills, including a track record of navigating through difficult economic periods without any significant losses.

We are excited by the depth and breadth of opportunities available in Fixed Income. For as long as the cash rate stays at or around current levels, very attractive returns are possible with reasonably low risk.

We are continuing to research additional opportunities. After pretty much avoiding the sector entirely while interest rates were extremely low, we now expect Fixed Income to be a key component of the Affluence Investment Fund portfolio for some time.

We hope that was helpful.

If so, here are some other things you might like.

See more of our articles.

Find out about our Funds.

You can also sign up to receive our monthly eNews at the bottom of this page. It includes Fund updates, investments ideas and other things we find interesting.