West Street European Private Credit Fund (AUD)

Key Details

Profile date: February 2025

Fund: West Street European Private Credit Fund (AUD)

Manager: Goldman Sachs Asset Management

Investment Type: Wholesale Unlisted Fund

Asset Class: Global Corporate Debt

Investment Strategy: The Underlying Fund invests in senior secured corporate debt in high-quality, mostly private equity-backed companies, primarily in Europe.

Affluence Allocation: The Affluence Income Trust has a portfolio allocation of approximately 3.5% to the West Street European Private Credit Fund (AUD).

What is the West Street European Private Credit Fund (AUD)?

The West Street European Private Credit Fund (AUD) provides indirect exposure to a diversified portfolio of high quality European private credit loans across non-cyclical industry sectors. The Fund provides indirect access to Goldman Sachs Asset Management’s (GSAM) 28+ year track record and expertise in private credit investing. The Fund has been established in Australia through Channel Investment Management Limited, an Australian Responsible Entity.

GSAM are one of the world’s largest alternative investors. They currently manage over €500 billion of alternative assets, including over €100 billion in private credit. GSAM have over 25 years experience lending in Europe, and benefit from their relationships across the full investment banking ecosystem.

GSAM focus on larger size loans, with a target transaction size of $100 million to greater than $1 billion. They are one of the few groups that can accommodate borrowers of this size. The borrowers are mostly private equity investors/sponsors looking to finance their purchases.

The Fund gains exposure to these assets through an AUD class of units in an underlying fund, which is a European master fund managed by Goldman Sachs. There are approximately €1.3 billion of net assets in the underlying fund. The AUD class of units is fully hedged back into Australian dollars to remove the currency risk.

The underlying fund seeks to achieve its investment objectives by:

- Directly originating senior secured debt with borrowers, leveraging Goldman Sachs’ global network of relationships with sponsors and corporates.

- Targeting high quality medium to large businesses in non-cyclical sectors.

- Disciplined investment selection with intensive due diligence and credit analysis.

- Co-investing with other senior credit vehicles managed by Goldman Sachs that together allow for large-sized commitments to drive enhanced risk adjusted returns.

- Focusing strongly on credit documentation and covenant protections.

The Underlying Fund can also hold up to 20% of the portfolio in subordinated investments. These are loans that rank behind senior secured debt and offer higher returns in exchange for higher risk.

The Underlying Fund allocates up to 20% of the portfolio to liquid Investments. This provides cash flow flexibility, and helps to ensure the Fund can satisfy its liquidity and redemption requirements.

Another important factor is that the Underlying Fund uses leverage to enhance returns. The target leverage ratio is set between 50-55% of the gross asset value. While this does enhance positive returns, it also increases the overall risk of the investment.

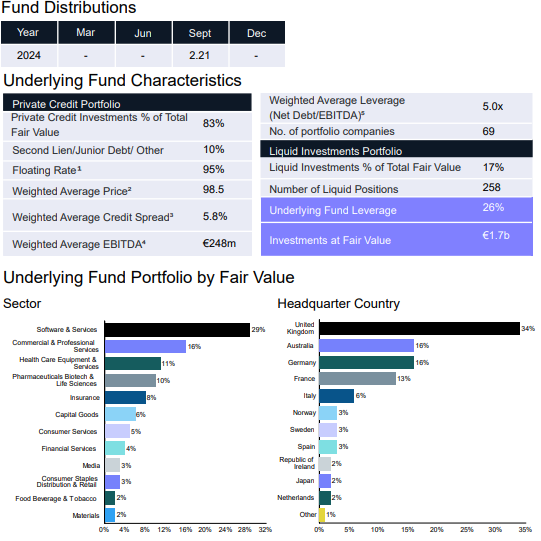

The following summarises the current portfolio statistsics:

While the Underlying Fund has been operating a relatively short period, it benefited from Goldman Sachs warehousing a portfolio of loans on their own balance sheet to transfer into the Underlying Fund. This has resulted in the Underlying Fund being very well diversified straight away. As at the last update the portfolio included loans to 69 companies. The largest individual loan represented only 4.5% of the total portfolio.

West Street European Private Credit Fund (AUD) Performance

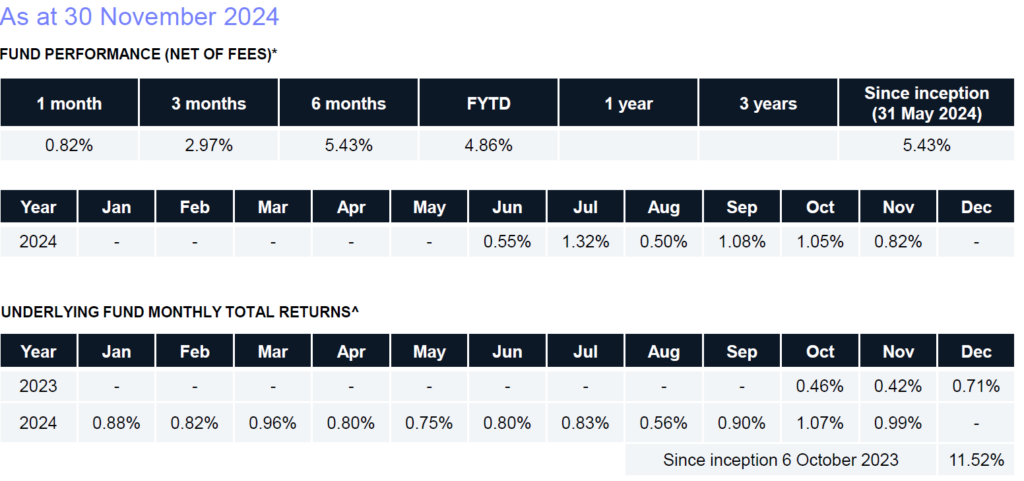

The following table shows the monthly returns for both the AUD Fund and the Underlying Fund:

The Fund and underlying fund have a relatively short history. However, GSAM have demonstrated much longer, attractive performance history through various other funds and mandates which comprised a similar investment strategy to this Fund.

As important as assessing returns, is assessing the defaults and losses of the manager. GSAM advise that their senior lending strategy has never experienced a realised loss. They also focus on the sectors and sponsors that they have strong credit characteristics.

Why we like the Fund

GSAM are one of the leading private credit investors globally. These types of products are normally only available in Australia to large institutional investors.

One of our objectives for the Affluence Income Trust is to diversify the portfolio by manager, sector and geography. This Fund provides exposure to the credit of very large companies, backed by some of the best private equity investors. It is well diversified, has reasonable portfolio concentration, excellent investment management and attractive returns.

While the manager has a long and successful track record with this strategy and the gearing does increase returns, it also has the potential to magnify and losses or defaults the underlying investments may experience. For this reason, we allocate less to this Fund that we might if it were ungeared.

Conclusion

Based on current interest rates, we expect the West Street European Private Credit Fund (AUD) to produce net returns in excess of 10% per annum. This investment strategy is very different other Affluence Income Trust investments, and is thus complimentary to the portfolio. It provides the potential for double digit returns, with a relatively low risk profile.

We hope that was helpful.

Learn more about the Affluence Income Trust.

If you enjoyed this Investment Profile, view our December 2024 profile WAM Leaders – Affluence Funds Management

Want to learn more about Fixed Income?

You can download our Fixed Income Guide – Affluence Funds Management

Disclaimer

This Fund Profile was prepared by Affluence Funds Management Limited (Affluence). It was prepared to assist investors in various Affluence funds in understanding the investments of the relevant Affluence fund in more detail. It is not an investment recommendation. Prospective investors are not to construe the contents of this article as tax, legal or investment advice. Neither the information nor any opinion expressed constitutes an offer by Affluence, its subsidiaries, associates or any of their respective officers, employees, agents or advisers to buy or sell any financial products nor the provision of any product advice or service.

This Fund Profile does not take into account your objectives, financial situation or needs. In deciding whether to acquire or continue to hold an investment in any financial product, you should consider the relevant disclosure documents for that product which are available from the product provider. Affluence recommends you consult your professional adviser before making any decision to invest.